Annual Income Verification Documents

To apply for an increase of your borrowing limit to between 1,000,000 yen and 3,000,000 yen, you are required to upload an image of your most recent annual income verification document.

Select one of the annual income verification documents listed above.

| Customers who are employment income earners |

|

|---|---|

| Customers who file tax returns or who are self-employed |

|

- *Please note that your application for an increase of the borrowing limit may not be accepted in the following cases.

Deficiency of the uploaded image

- -The image is blurry, shadowed or unclear.

- -The image does not show the entirety of the document. (Please see "Typical examples of unacceptable images" shown below.)

Deficiency of the annual income verification documents

- -The amount of income you entered does not match the amount indicated in the annual income verification document.

- -The official seal by the tax office or the seal of the issuer of the certificate cannot be identified.

- -The image has been edited.(Please see "Examples of annual income verification documents"

Typical examples of unacceptable images

- *You can bring the document into focus easily by resting your arms on something and holding the camera steadily.

- *Take a photo so that it shows the entirety of the document clearly and in a large size, using as much space as possible.

- *If your annual income verification document is long in the horizontal direction, take the photo using a horizontally long frame.

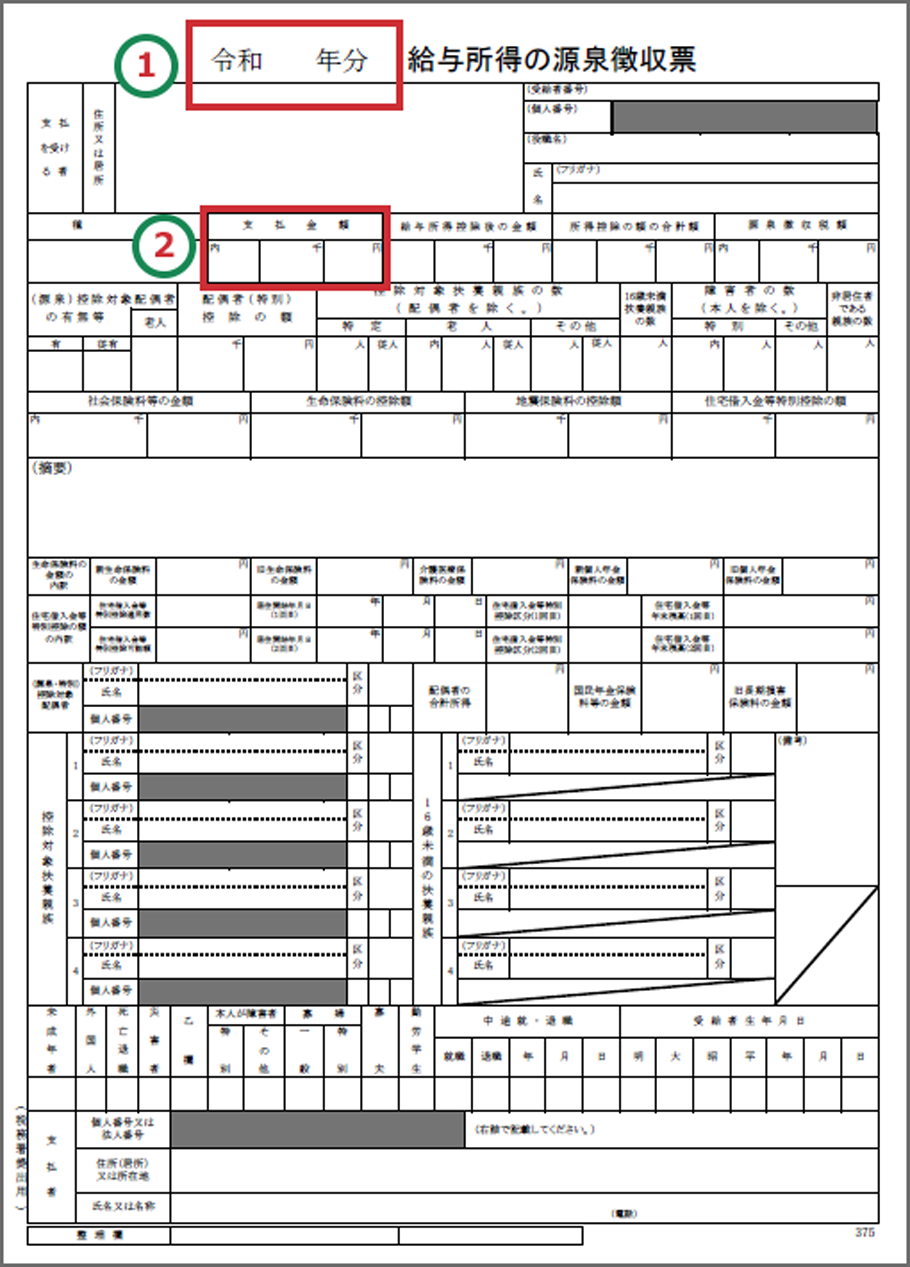

Examples of annual income verification documents

- *If your individual number is indicated in the document, please black it out so that the individual number cannot be identified.

- *If you have more than one withholding certificate due to a job change or for other reasons, please submit a notice of inhabitants tax or a taxation (income) certificate issued by the municipality.

Please submit the most recent withholding certificate.

In the "Amount of annual income" field, enter the amount indicated in the "Amount paid" column in the red frame.

- *If your individual number is indicated in the document, please black it out so that the individual number cannot be identified.

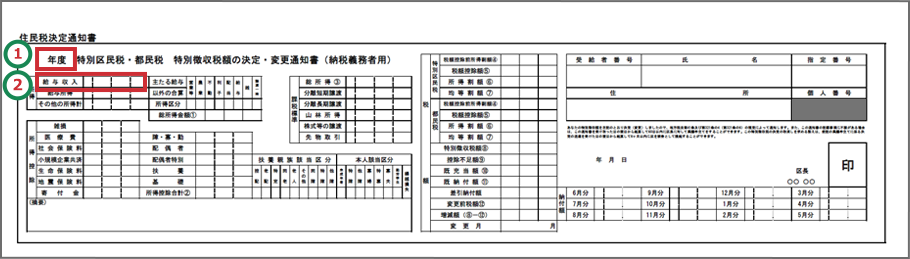

Please submit the most recent notice of inhabitants tax.

* A taxation (income) certificate is provided by your workplace around mid-May each year.

In the "Amount of annual income" field, enter the amount indicated in the "Employment income" column in the red frame.

- *The form differs depending on the municipality

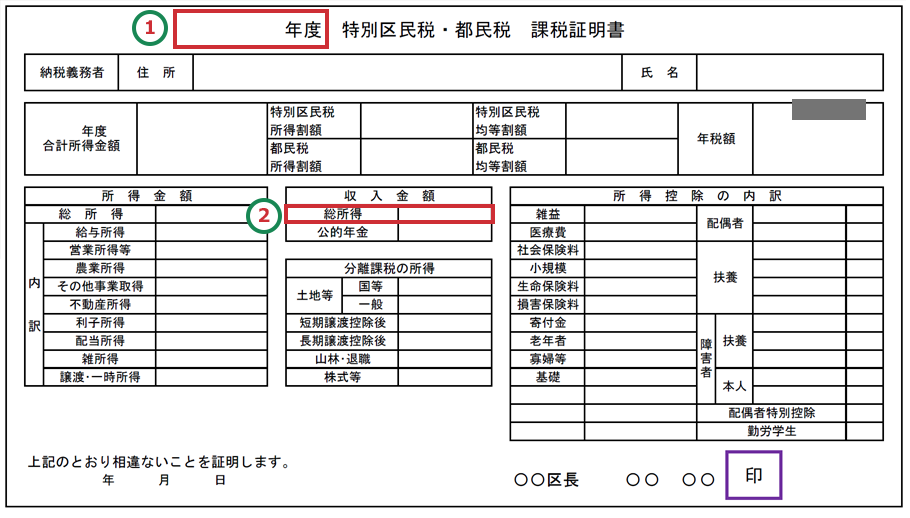

Please submit the most recent Taxation (Income) certificate issued by the municipality.

In the "Amount of annual income" field, enter the amount indicated in the "Gross income" column in the red frame.

- *If your individual number is indicated in the document, please black it out so that the individual number cannot be identified.

- *Please submit the tax return with a receipt stamp of the tax office, or, if you use the e-Tax system, a copy of the tax return and the notice of receipt.

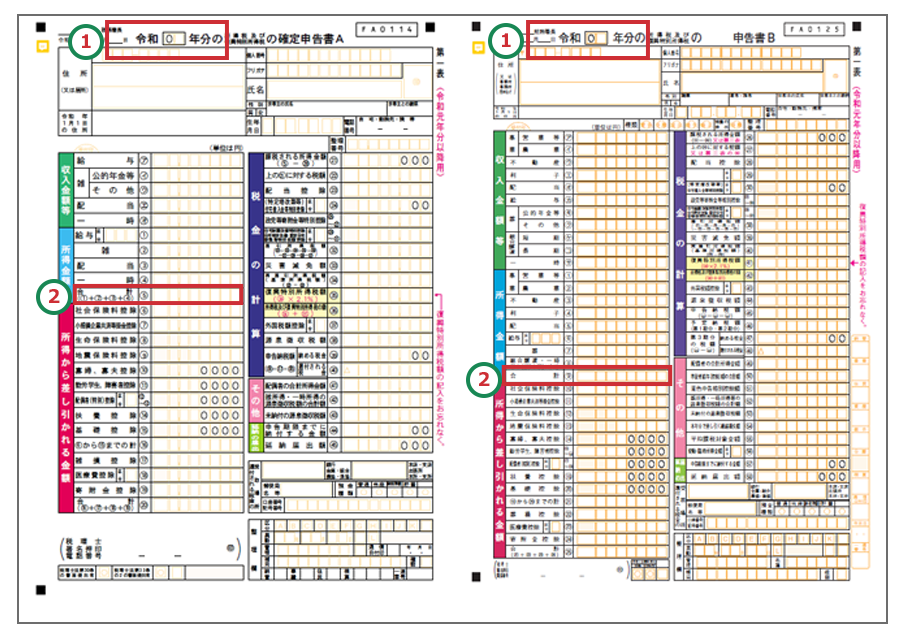

Please use Table 1 of the most recent tax return A or B.

In the "Amount of annual income" field, enter the amount indicated in the "Total" column under the "Amount of income, etc." in the red frame.