Useful Features

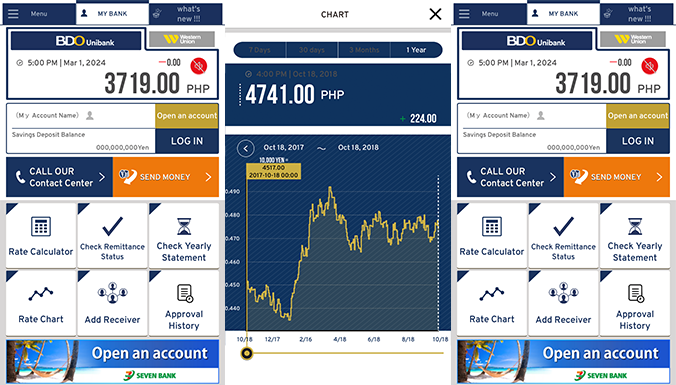

You can immediately check the current exchange rate.

You can send money to the Philippines via mobile banking App.

- * Mobile Remit sa 'Pinas is available only when you remit via App.

- * International money transfer service may sometimes be temporarily unavailable due to system maintenance and other related issues.

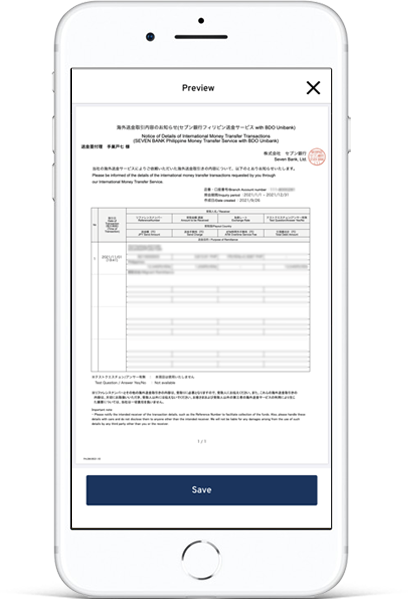

You can get the remittance details from the app.

- * Log in to Online Banking (Direct Banking Service) is required.

-

International Money Transfer Service

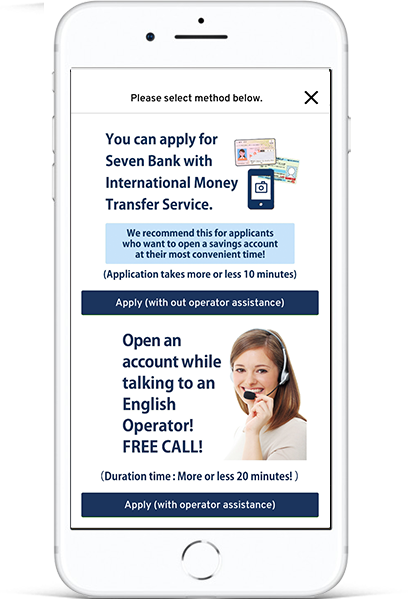

2 Ways to Apply

* To apply, your Residence Card and My Number will be required.

-

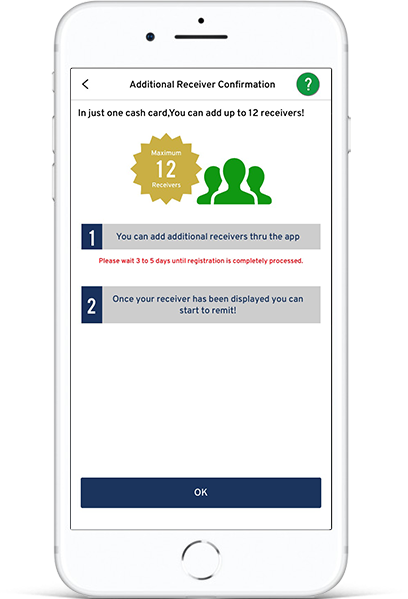

You can easily add or delete receiver.

* Please wait 3 to 5 days until registration is completely processed.

* Log in to Online Banking (Direct Banking Service) is required.

-

You are supported by our multilingual staff in 9 languages.

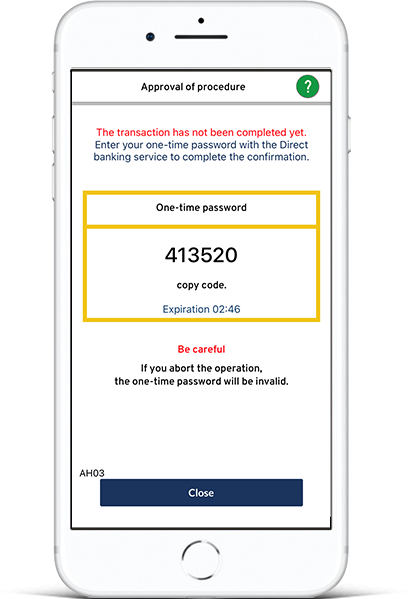

App Authentication

This service allows you to use the Direct Banking Service more securely.

For customers who have set up the app, app authentication will be introduced when using Direct Banking.

(You do not need to enter the confirmation number)

- *Use of the app authentication function is free.

App authentication for the international money transfer app is a service when using the English version of Direct Banking.

When using the Japanese version of Direct Banking, please use the My Seven Bank app.

App registration settings

If you use the money transfer service to the Philippines or the app authentication function, you need to configure the app usage settings.

App settings require authentication at an ATM. Bring your cash card and smartphone to the nearest Seven Bank ATM.

How to set up ATM usage

-

STEP

-

STEP

-

STEP

-

STEP

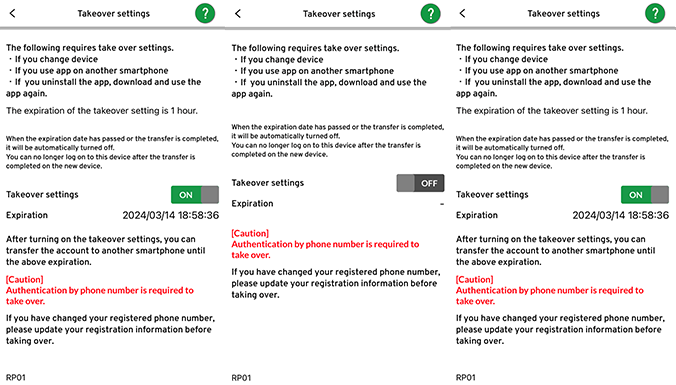

Takeover settings

Only one device can be set to use the international money transfer app per account.

Transfer settings are required in the following cases.

To take over the app, please either

1. make the app usage settings again at the ATM (details here![]() ), or

), or

2. take over by phone authentication.

1. Use the app again at the ATM

You can use it by setting the usage again on a new device.

You need to insert your cash card into the ATM and go through the authentication procedure.

Once the settings are completed on the new device, you will not be able to log on with the apps already set on the old device.

2. Transfer by phone authentication

①Turn on the takeover settings using your old device.

Please confirm that the takeover setting is turned "ON" on your old device before you proceed to the next step.

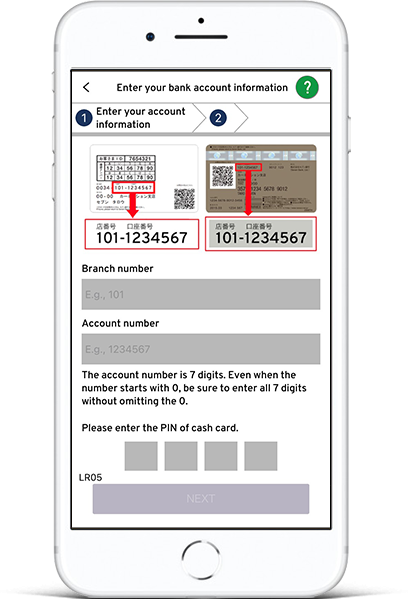

②Enter your bank account information

You will need to enter your branch number, account number, and password. Please have your cash card ready.

- * Click here if you have forgotten or expired your PIN

- * Please complete the procedure after resetting your PIN.

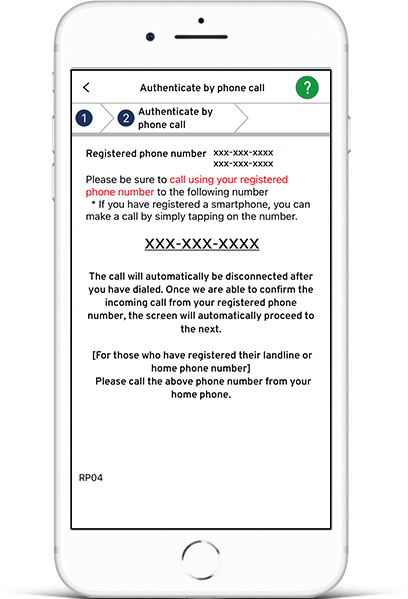

③Authenticate by phone call

Authentication is performed by calling from the phone number registered in Seven Bank.

- *The call will be disconnected automatically after you have dialed. (For iPhone users, please press the cancel button.) If we can confirm the incoming call from the registered phone number, it will automatically proceed to the next screen.

- *If you have changed your registered phone number, please follow the procedures to change your registered information from the Direct Banking Service before transferring. You can log on directly to the relevant page here.

(For smartphone users, click here

(For smartphone users, click here .)

.) - *Customers whose phone number notification setting is OFF when making a call cannot use this service.

- *If you cannot set up transfer on your old device/app, you will need to set up the app again at the ATM.

Phone authentication uses the incoming authentication of Ostiaries,Inc

It is prohibited to post the phone number used for authentication on SNS etc.

④App passcode settings

Please set a 4-digit passcode.

Recommended environment/Terms of use

- SEVEN BANK Money Transfer

-

This is the Seven Bank official app. We support 9 languages: Japanese, English, Tagalog, Chinese, Thai, Vietnamese, Indonesian, Portuguese, Spanish.

The exchange rate notification service is a push notification service where you will be notified when the set amount is reached.

Exchange rate chart are displayed starting from today's rate, 7 days ago, 30 days ago, 3 months ago and up to 1 year ago. You can jump into any graph to compare the currency trends and find the best rate.

You can also learn step-by-step process for banking transactions such as International Money Transfer Service by watching our video tutorials.

In addition, you can easily search the payout locations (Pick-up location).

- ● Exchange rate notification

- ● RATE CHART

- ● Video support

- ● Balance Inquiry

- ● Receiving areas

- ● Simulation

- ● Money Transfer Organizer

- ● Contact Center outbound call function

- ● Announcements alert notification service

- ● "Account application with Operator support" function

- ● "Add or delete receiver" function

- ● Submission of My Number

- * All functions are displayed in 9 languages. Language can be selected.

- * You can view past history of exchange rates from period of May 2015.

Recommended environment (supported OS)

- For iOS iOS14.0 - 16.0

- For Android Android9.0 - 13.0

- * Even with the above recommended environment, the service may not be available depending on the condition of the customer's device.

- * You cannot upgrade or re-install the International Money Transfer App on devices with iOS 11 or less and Android 5 or less.

Terms of Use for the "Seven Bank International Money Transfer App"

The Terms of Use for the "Seven Bank International MoneyTransfer Service App" ("TOU") define conditions for the use by customers of the Seven Bank International Money Transfer App ("This Service") provided by Seven Bank, Ltd. ("Bank") that uses the Seven Bank International Money Transfer App ("This App") downloaded onto the customer's smartphone ("Device").

- Article 1. Scope of the TOU

- When using this service, the items defined in the TOU take priority over other TOU defined by the Bank ("Banking Terms of Use and Other Rules"), such as the Seven Bank Banking Terms and Conditions. If there are no special exceptions, the items defined in Banking Terms of Use and Other Rules are also applicable to this service, and the Banking Terms of Use and Other Rules are applied for any items not defined in the TOU.

- Article 2. Definitions

-

- 1.Direct Banking Service means the service that allows the Seven bank account ("Account") holders to perform transactions, such as balance inquiries and domestic transfers, and use various procedures from a computer, smartphone, and other devices.

- 2.Logon Information is the general term for (i) the logon ID and password required to log on to the Direct Banking Service. The logon information registered in this application shall be encrypted within the application and saved.

- 3.App Passcode means a 4-digit number chosen and set by the user of this app's log in function, and is used to authenticate the user when logging on to this app's log in function.

- 4."Retrieval Information" is information obtained from Direct Banking Service (this includes, but is not limited to account name and account balance).

- 5."Seven Bank International Money Transfer Service (International Money Transfer Service)" is a service where funds can be transferred through ATM and Direct Banking Service.

- 6."Seven Bank Philippines Remittance Service with BDO Unibank (Mobile Remit sa 'Pinas Service)" is a service where funds can be transferred to the Philippines through this smartphone application.

- 7.“My Number” is a unique 12-digit number that is assigned to each person who possesses a Resident Record in Japan. (Including foreign nationalities)

- 8.If the terms defined in Seven Bank overseas remittance service provision is used, unless the meaning is interpreted differently in the context, it shall have the same meaning with the overseas remittance terms and conditions.

- Article 3. Details of This Service

-

The details of this service are the following functions provided that this app uses.

- 1.Remittance Rate Notification Function

This function provides push notifications when the foreign exchange rate used to convert remittance funds into the received remittance amount (Remittance Rate) through International Money Transfer Service and Mobile Remit sa 'Pinas Service has reached the value set by the customer. In order to use this function, the customer must agree to the "Terms of Use of the Exchange Rate Push Notification Service". - 2.Remittance Management

This function enables users to manage overseas remittance transaction history by themselves. However, when using the remittance management function, users shall agree to the "Terms of Use for the Remittance Management Service" that is specified separately. - 3.Exchange Rate Chart Display Function

This function is to check the foreign exchange rate used for International Money Transfer Service and Mobile Remit sa 'Pinas Service.

The foreign exchange rate applicable at the actual time of using the International Money Transfer Service and Mobile Remit sa 'Pinas Service may differ from the exchange rate notification in this app.

Please confirm the exchange rate displayed at the time of your transaction. - 4.Information Notification function

In addition to various announcements from our company, it is information browsing function such as administrative information and shopping information. - 5.Contact Center Call Function

It is a call function to our Contact Center. - 6.Tutorial Video function

This is a video tutorial function on how to use our services. - 7.Pick up location function

This is a function to search pick up locations for International Money Transfer Service and Mobile Remit sa 'Pinas Service. - 8.Log-in Function

A function that enables log in as well as various types of online customer procedures by accesing the Direct Banking Service through the login information from this App. In order to use this function, first time users registration for Direct Banking Service must be duly completed. Fisrt time users registration can be done on this app or the official page of Seven Bank. - 9.Direct Banking Service Registration Function

This function enables initial registration of the logon ID, password, and other items specified by the Bank required to use the Direct Banking Service. - 10.Debit Service Registration Function

This function allows access to direct banking service from this app from log in information and performs the procedure of application (switching) of debit service. To use this function, application for Seven Bank account and registration for use of Direct Banking service must be duly completed. Also, if you have already signed up for Debit service, you can not re-apply again. In addition, when applying for debit service, you agree to the Terms of Use of Seven Bank Debit Service that is specified separately. - 11."Additional and Deletion of Receiver" Function

This function enables access to Direct Banking Service by logon information from this app and performs the procedure of adding / deleting receivers for overseas remittance service within this app. In order to use this function, it is required to duly complete the registration for Seven Bank account and International Money Transfer Service contract, Direct banking Service First Time Users Registration. - 12."Account Application with Operator Support" Function

This function allows app for Seven Bank Account and app for International Money Transfer and Debit Service at the customer's device by using the calling function of Contact Center of Article No. 5 while talking with an operator. During application process, taking photos of Identity Confirmation Documents and My number documents etc are required. In addition, custimer must agree to each important provision and Seven Bank Account Regulations separately specified. - 13."Mobile Remit sa 'Pinas Service" Function

This function enables customers to remit funds to the Philippines through this app by accessing the Direct Banking Service using the customers' log in ID. In order to use this function, customers must have an account, have already registered to use the International Money Transfer Service, as well the Direct Banking Service. Moreover, customers must also agree to the "Terms of Use of the International Money Transfer Service and the "Terms of Use of the International Money Transfer Service Special Contract (Seven Bank's Philippines Remittance Service with BDO Unibank)". - 14.Mobile Remit sa 'Pinas Service History Confirmation Function

This function enables customers to confirm historical transactions of the Mobile Remit sa 'Pinas Service by accessing the Direct Banking Service after the customer has logged in. The information described in this function is the information at the time the customer last downloaded data through this function. Because there is a possibility of changes depending on the condition of the transaction, customers must confirm the content after downloading the data. - 15.Submission of My Number

A function that enables you to submit My Number/Individual Number to Seven Bank using this app for customers who signed up on international money transfer service but have not yet submitted My Number/Individual Number.

When you submit, taking a photo of your personal identification documents and My Number/Individual Number is required. - 16. App authentication function

This is a function that allows you to verify your identity and displays its history when using the Direct Banking Service.

- 1.Remittance Rate Notification Function

- Article 4. Function Restrictions

-

- 1.When registering for the first time using this app, you will need to set an app passcode. If your device supports fingerprint authentication, you can use fingerprint authentication instead of the app passcode to log on to this app.

- 2.When using log in function, debit service function, addition/deletion of receiver function, Mobile Remit sa 'Pinas Service function and Money Transfer Organizer (Below "Log in related transactions"), customers must agree to the following restrictions.

- (1)If the specifications of the data retrieval website change, Log in related transactions may not be available due to the system operation or the customer use status.

- (2)Some of the information that the app displays is information processed and/or edited based on the retrieval information. If there are doubts about the information displayed on the app or the latest information must be checked, check the information by directly accessing the data retrieval website.

- (3)As the retrieval information is retrieved from the data retrieval website and updated when the customer logs on to the app and when the customer updates the information on the app, some of the information displayed on the app may be different to the latest information on the data retrieval website.

- (4)Moreover, from the time that the customer logs on to the app or updates the information until the information is updated, information displayed prior to the update is displayed on the app.

- (5)If the customer cannot log on to the data retrieval website with the logon information registered on the app because the customer changed the logon information but did not update the information registered on the app or similar reasons, the customer may not be able to use the data retrieval website.

- 3. Customers shall agree to the following restrictions when using the app authentication function.

- (1) The Bank shall not be held responsible for any inability to use the Direct Banking Service due to customer operations that differ from those displayed on the Direct Banking Service by the Bank.

- (2) The Bank shall not bear any responsibility even if the customer cannot use the app authentication function and cannot use the direct banking service due to a malfunction of the customer's smartphone.

- (3) The Bank assumes no responsibility even if the customer cannot use the app authentication function and the Direct Banking Service due to insufficient provision of services by telecommunications carriers, etc.

- (4) The app authentication function can be used on devices recommended by the Bank as stipulated in Article 9, Paragraph 5. Under circumstances where these conditions are not met, the customer cannot use the app authentication function and uses the Direct Banking Service. Even if it is not possible to do so, we do not take any responsibility.

- Article 5. Use of This Service

-

- 1.Registration is required to use the Seven Bank account and International money transfer service, you need to open a Seven Bank account and to apply for an international money transfer service agreement.

- 2.This app is free to use. However, customers are responsible for any communication charges, International Money Transfer Service and Mobile Remit sa 'Pinas Service fees that are incurred when downloading and using this app.

- 3.To use this app for the first time, the customer must perform the initial setup procedure below. If the customer does not perform the initial setup procedure below, some or all of the functions on this app will not be available.

- (1)Customer Language Setting

- (2)Currency Display Setting

When the set-up for this App is completed, the customer can now start using the App with the language and currency that has been set.

- 4.To use some functions, it is necessary to register account information in this app. When registering account information, you will need to issue an authentication code at an ATM. When issuing an authentication code, please follow the screen display of this app and ATM and other operating procedures prescribed by the Bank.

- 5.At the time of registration in the preceding paragraph, the Bank will acquire information identifying the device used by the customer and register it as the device used by the customer to use this service.

- 6. To use other functions, logging on to Direct Banking Service is necessary.

- 7.In some parts of this application, links and banners can be used to transfer from the application to other websites. The linked website to which the user is transferred is managed by the respective company and is not managed by Seven Bank. As a result, note that Seven Bank shall not be responsible for the posted content of that website.

- 8.Regarding the notification for this app, push notifications may be delivered with or without the user's consent.

- 9.If the customers allow their current location in using this application, they will be subject to the terms and advertisements of the third parties related to the company.

This ensures, therefore, that we will not retain any personally identifiable information from any individual customers. - 10.Services and transactions provided by the Bank, including this service, are provided in Japanese. To convenience and help customers, content may be displayed in other languages. However, the content displayed in other languages is limited. Moreover, if there are any discrepancies in the translated content, the Japanese version takes precedence over the translated content.

- 11.If the customer deletes the app but wants to use it again or changes their device, the customer must download the app again.

- 12.Additionally, if the app does not function correctly, the customer must delete the app and download it again.

- 13.Note that if the customer deleted the app, initial setup is required, and the information saved in this app before it was deleted (this includes, but is not limited to, logon information, retrieved information) cannot be restored.

- Article 6. Device Management

-

- 1. The customer must strictly manage the device at the customer's responsibility.

- 2.When the customer sets the app passcode, avoid using date of birth, the same number repeatedly, telephone number, or any other password that can be easily guessed by another person. Also change the passcode with the procedures prescribed by the Bank and stringently manage the device so that other people cannot find out the passcode.

- 3. The app can only be used in one device only.

- Article 7. Handling of model changes, etc.

-

- 1.If the customer changes the devices used for this app due to model change etc., it is required to perform one of the following operations.

- (1)Complete the initial settings again using the authentication code from the ATM on your new device after changing the model.

- (2)On your old device, this app must be set to takeover mode

- 2. After the operation in (2) of the preceding paragraph, if the app is downloaded on a new device after model change, and if the Bank is able to confirm that it matches the phone number that has been notified to the Bank (hereinafter referred to as "phone authentication") ) can be initialized again. If you do the initial settings again, the new device will be registered as the device you will use, and you will not be able to use this app on the old device. In addition, if the customer has changed the information (phone number, address, occupation, etc.) that has already been submitted, the initial settings cannot be made by phone authentication for a certain period of time.

- 3. If you reinstall this app on the same device after uninstalling it, you need to take over before uninstalling. If you uninstall the app without setting it to transfer status, you can use the authentication code from the ATM to complete the initial settings without setting to transfer status.

- 1.If the customer changes the devices used for this app due to model change etc., it is required to perform one of the following operations.

- Article 8. Handling of Information

- The Bank appropriately handles logon information, retrieval information, and other information related to customers based on the Privacy Policy posted on the Bank's website.

- Article 9. Disclaimers

-

- 1.The Bank shall not be liable for any damage to customers caused by any failure or delay in provision of this service due to device faults, changing devices, device initialization, use when the device power is off or the device is out of signal range, communication device and computer faults, and line faults.

- 2.The Bank shall not be liable for any damage to customers caused by or related to the loss of information saved in the app or any failure or delay in provision of this service due to natural disasters, war, terrorism or the like that cannot be attributable to the bank, or unavoidable circumstances, such as measures taken by public agencies, such as a court.

- 3.The Bank shall not be liable for any damages caused by leaks or tampering of logon information due to the bugging of communication routes, such as public phone lines, dedicated phone lines, and Internet and other communication lines.

- 4.The Bank shall not be liable for any damages caused by unauthorized use of the app due to device loss, theft, or the like and account information being read by a third party.

- 5.The use of this app is recommended on a device designated by Seven Bank (hereinafter referred to as "recommended device") posted on our website. The device recommended by the Bank does not guarantee the normal operation of the App when the customer uses the App on such device. Even if this app becomes unusable on the device used by the customer due to a change in the device recommended by the Bank, the Bank shall not be held responsible for any damages incurred by the customer. In addition, it cannot be used on devices that have been illegally modified.

- 6.The Bank shall not be liable for any damages caused by any failure or delay in provision of this service due to the customer not downloading the latest version of this app to the device.

- 7.Please be aware of the third party applications similar to this application.

When using this application, go to the app market from our website to download the application.

Note that the address shown in the browser address bar of application download screen of our website always begins with "https://www.sevenbank.co.jp/" - 8.The Bank shall not be liable for any disadvantages that arise when customer uses this app unless there is deliberate or serious neglicence from The Bank.

- Article 10. Intellectual Property Rights

-

- 1.Copyrights related to this app and any other intellectual property rights belong to the Bank.

- 2.The customer may not reproduce, copy, modify, store, forward, alter, or reverse engineer the app program and information related to the app.

- 3.The customer may not perform actions that infringe upon the Bank's rights related to this app or perform any other actions that may infringe upon said rights.

- Article 11. Change, Addition, and Discontinuance of This Service

- The Bank may change the content of this service (including discontinuing the service itself), such as the type of functions, due to circumstances related to the Bank. In this case, use of this app may be temporarily suspended in order to change the service without prior consent of the customer. Moreover, the Bank is not responsible for any disadvantage to the customers caused by the delay or cancellations of transations caused by temporary suspension of this service.

- Article 12. Changes to This TOU

- The Bank may change the details of this TOU. In this case, the Bank will notify customers of any changes designated by the Bank.

If the customer uses this service after the TOU is changed, the Bank will assume that the customer agrees to the changes and apply the changed TOU. - Article 13. Governing Law and Jurisdiction

-

- 1.This TOU and other rules shall be governed by the laws of Japan.

- 2.The Tokyo District Court shall have exclusive jurisdiction over any litigation that arises in relation to this TOU and other rules.

(As of February 20, 2023)

Exchange Rate Notification Service Terms of Use

Please agree to the provisions of the following Terms and Conditions of Use for Exchange Rate Notification Service for Seven Bank application for smartphones.

- Article 1 (Exchange Rate Notification Service Definitions)

-

- 1.The Exchange Rate Notification Service (herein referred to as "This service") is a service that sends push notifications when the exchange rate preset by the user has been reached (herein referred to as "Reached Amount") when using Seven Bank application for smartphones (herein referred to as "This application").

- 2.The exchange rate use in this service, is a foreign exchange rate prescribed by Seven bank calculated by converting Japanese yen to the foreign currency designated by the user. This foreign exchange rate includes the margin predetermined by Seven Bank.

- 3.In principle, the foreign exchange rate will be changed three times a day (as of April 11, 2012). However, push notifications will be sent at the time the specified rate has been reached. It may take time to push out notifications due to system maintenance and signal conditions or any other circumstances, and with such reasons, notifications to users may be delayed or may not at all be notified.

- 4.The exchange rate to be applied at actual time of using International Money Transfer Service may differ from the exchange rate notification sent by this service.

When you transact, you may check the applied rate that will be displayed at the time of your transaction.

- Article 2 (Expiry of Settings Condition)

- The content of the push notifications that the user has set, may at some cases become invalid when the set rate is reached, or should the rate not be reached even after a certain period of time, the settings will be disabled by the discretion of Seven Bank. If you wish to continue receiving notifications, reset of settings is required.

- Article 3 (Disclaimer)

-

- 1.When using this service, Seven Bank shall not be liable to you nor assume responsibility for any losses incurred on the user as a result of this service not properly functioning or of usage unavailability

- 2.This service is intended solely to provide reference information. Note that Seven Bank shall not be liable nor assume responsibility in any case caused as a result of user's transactions or any such kind of actions based on the information displayed in this service.

- 3.Duplication, distribution, reproduction and modification of the content of the notifications sent by Seven Bank is strictly prohibited.

- Article 4 (Other Information Offered)

- This service may at times send notifications such as promotion notices and much more, other than the information that the user has set up.

- Article 5 (Changes in Services, Termination and Terms of Use and Conditions)

- This service, contents, and the terms and conditions of use in this service may be changed or terminated any time at the sole discretion of Seven Bank without prior notice to the users and without acquiring user's consent.

Terms and Conditions of Using our Money Transfer Management Services

To use our smartphone application (henceforth "this application") for money transfer management services, users must adhere to the following terms and conditions:

- Article 1 Money Transfer Management Service

-

- 1. "Money Transfer Management Service" (henceforth "this service") enables users to manage overseas remittance transaction history by themselves. The function to import and manage the statements of overseas remittance transactions are available from this app. However, until October 17, 2021, "Money Transfer ATM Receipt" (hereinafter referred to as "ATM Receipt") issued at the time of remittance transaction at Seven Bank ATM, that have been taken photos of using the camera function of this app, can still use the information obtain from the ATM receipt in the money transfer organizer. Starting from October 18, 2021 onwards, the taking photo of the ATM receipt function and the money transfer organizer function of the money transfer management function for the ATM receipts can no longer be used from newly downloaded apps (including re-downloaded apps).

- 2. When importing the remittance statements of overseas remittance transactions, users are required to access the direct banking service from this app using their logon information. Moreover, the imported remittance statement cannot display both transactions from the Mobile Remit Service sa 'Pinas (with BDO Unibank) and International Money Transfer Service (Western Union) simultaneously. If you are using both services, you will need to download the data separately for each service.

- 3. The information stated on the imported remittance statement for transactions made with Mobile Remit Sa 'Pinas (with BDO Unibank) will be the information at the time the customer used the service and on the day data was imported. On the other hand, for transactions made with Seven Bank International Money Transfer Service (Western Union), the information is taken the day before the data was imported. Since the remittance history information may change depending on the status of overseas remittance transactions, you need to regularly check the contents after you have downloaded the data.

- 4.Images of ATM receipts taken will be recorded in your smartphone's album and also in this APPlication as a text data. If users change their smartphone device, the image and text recorded in the APPlication will not be downloaded to their new device. Users must back up and copy the data to their new device manually. * If you want to use this app again after deleting it, or if you change device, etc., you will need to download this app again. However, after October 18, 2021, the remittance management function using ATM receipts will no longer be available in the newly redownloaded apps.

- 5.When recording images through this app's camera function, there is a possibility of information mismatch between what is stated in the receipt and the recorded information (henceforth "recorded information) with the image taken by using the APPlication due to poor image quality or other factors. Users of this APPlication are advised to double check/confirm prior storing the image to the APPlication.

- Article 2 Limitation of Liability

-

- 1.Our company is not responsible or liable in any manner for any loss generated by mismatch between recorded information and information stated in ATM receipt.

- 2.Our company is not responsible or liable in any manner for the validity of ATM receipt images recorded through this service to be used as documents of proof of transactions to beneficiaries abroad. Contact related institutions to confirm the validity of the documents.

- 3.In each ATM receipt, a MTCN (Money Transfer Control Number) is stated and is used as code for conducting the remittance. Maintain the secrecy of the MTCN from any unrelated parties. Our company is not responsible or liable for any loss generated by management of ATM receipts' information by customers.

- Article 3 Alteration ・ Termination of Services and Alteration of Terms and Conditions

- Our company can at any time terminate this service, make alterations to this service and make alterations to the terms and conditions of this service without prior notice.

SEVEN BANK Money Transfer

- * Apple, Apple logo, iPhone is a registered trademark of Apple Inc. in the U.S. and other countries and regions.

- * The iPhone trademark is used under license from Aiphone Co. Ltd.

- * App Store is a service mark of Apple Inc.

- * IOS is a trademark or registered trademark of Cisco in the U.S. and other countries and is used under license.

- * Android, Google Play or Google Play logo is a trademark of Google LLC.

- * All on-screen images are simulated pictures. They may be subject to change at any time without prior notice.

- ◇ For other details, please refer to the Product Overview(Philippine Transfer Service with BDO Uniank) .