Supporting the TCFD recommendations

The Seven Bank Group recognizes the issue of climate change as one of its management material issues understanding that global warming severely affects the sustainability of companies. The Seven Bank Group expressed an endorsement of the Task Force on Climate-related Financial Disclosures (TCFD) in December 2021. In 2023, it conducted a scenario analysis to measure the impact of climate change risks and opportunities on our core ATM platform business. We analyzed the impact of climate change on our business activities and revenues, etc., and are taking specific measures, while enhancing information disclosure to stakeholders.

Governance

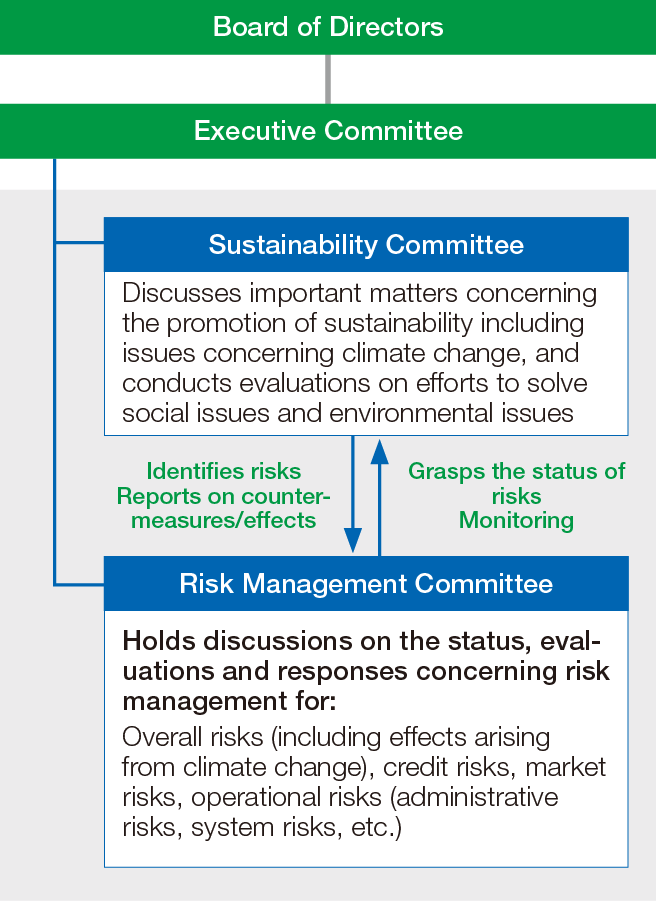

The Seven Bank Group defines “Response and approach to climate change linked to the Seven & i Group” as one of our focused items. Important matters related to climate change are discussed in the Sustainability Committee. We disclose such sustainability information, including the progress status of our initiatives addressing social and environment issues and prepare for external evaluation.

The Risk Management Committee is established as an advisory body to the Executive Committee related to risk management. Every fiscal year, the Board of Directors establishes the “Basic Policy on Risk Control,” which specifies the overall risk management policy, specific risk management policies and the organization and system for risk management. The Executive Committee sets risk control regulations and quarterly evaluates the overall risk status.

The Executive Committee determines a response policy for material items reported at the Sustainability

Committee and the Risk Management Committee, advisory bodies of the Executive Committee. The Executive Committee also supervises the progress of responses and target achievement status of each department and group company through the Sustainability Committee and the Risk Management Committee, reviewing the policy and initiatives as required.

The Board of Directors, on the other hand, based on discussions on sustainability in the Executive Committee, supervises the decisions and business execution of important matters in the basic policy and business management related to sustainability from a corporate management standpoint.

Climate change risks are also addressed through study of the situation and countermeasures, monitoring, etc. within the structure.

Strategy

The Sustainability Committee conducted a scenario analysis for the year 2030, based on information as of the end of March 2022 targeting our core ATM platform business. In the analysis, the financial impact due to the physical risk of extreme weather was estimated, which is assumed to have a significant business impact.

Analysis process

Conditions of assumed scenarios

The scenario analysis of climate change was conducted assuming the 2 degree limit scenario and the 4 degree scenario based on reports issued by International Energy Agency (IEA) and Intergovernmental Panel on Climate Change (IPCC). We identified a wide variety of potential factors impacting our ATM services under each of scenario, assessed the financial impact, and then identified risks and opportunities.

Assumption of scenario analysis

| Items | The 2 degree limit scenario | The 4 degree scenario |

|---|---|---|

| Reference scenarios | (2 degree scenario)IEA Sustainable Development Scenario, IPCC RCP2.6 (1.5 degree scenario)IEA Net Zero Emissions by 2050 | (4 degree scenario)IEA Stated Policies Scenario,IPCC RCP8.5 |

| Target year | As of 2030 | |

| Worldview | The scenario assumes an average temperature increase of less than 1.5°C above the pre-industrial level by 2100. Policies, laws, and regulations will be more stringent than now to achieve carbon neutrality to control problems from climate change. | The scenario assumes an average temperature increase of 3.2°C to 5.4°C (about 4°C) above the pre-industrial level by 2100. No proactive policies, laws, or regulations are put in place to mitigate problems from climate change, while extreme weather events intensify remarkably. |

Identified climate change risks and opportunities

| Type of risk/opportunity | Assessment item | Projected time-frame | Business impact | Financial impact | ||

|---|---|---|---|---|---|---|

| 4℃ | 1.5℃ | |||||

| Transiti- on risk |

Policy and regulations | Regulations on resource recycling | Medium- to long-term |

● Regulations on the distribution and use of fossil fuel-derived plastics used in ATMs will require shift to alternative materials such as bioplastics ● A shift to recyclable materials and structures will be required, increasing costs for adaptation |

− | Medium |

| Change in market | Change in raw material costs | Medium- to long-term | ● Increase in the prices of fossil fuel-derived plastics used in ATMs due to higher crude oil prices can increase manufacturing costs | − | Medium | |

| Change in energy costs | Medium- to long-term |

● Increased demand for renewable energy can bring up electricity prices and increase operating costs for offices and data centers

● Higher gasoline prices will increase costs such as guarded transportation costs |

− | Small | ||

| Physical risk | Acute | Frequent and intensified extreme weather events | Short- to long-term |

● ATM failures due to flooding, transportation networks disruption due to natural disasters, decrease of transactions due to shutdowns of business operators with ATMs installed, decrease of profitability of our core business ATM services

● The number of ATM transactions decreases as people go out less, resulting in lower income |

Large | Medium |

| Chronic | Rise in average temperature | Short- to long-term | ● Air-conditioning costs for offices and eastern and western data centers will increase | Medium | Small | |

| Opportu- nity |

Product and services | Growing environmental awareness | Medium- to long-term |

● Demand for replacement to Seven Bank ATMs will increase due to replacement of ATMs to those with advanced energy-saving functionality and due to an increasing interest in recyclable ATMs ● Demand for ATMs as sustainable social infrastructure will increase as the initiatives addressing climate change progress across the ATM network as a whole |

Medium | Small |

| Market | Need for cash in ordinary times/emergency situations | Short- to long-term |

● Rising temperatures will increase the number of customers visiting convenience stores and increase opportunities to use ATMs ● Demand for mobile ATM vehicle dispatch services as disaster response measures will increase ● Increased need for cash in the event of a disaster will increase the number of transactions |

Medium | Small | |

*Short-term: 1 year, Medium-term: 1 to 5 years, Long-term: 5 to 30 years

Calculation of financial impact

In addition, for the damage and impact of extreme weather events on our ATMs, which were evaluated as having a large business impact as a result of the scenario analysis, we estimated the frequency and probability of floods and storm surges occurring in the areas where our ATM locations nationwide using hazard maps and calculated damage to the actual ATM machines, including ATM recovery cost and financial loss due to ATM shutdowns, and estimated the financial impact.

| Assumptions | Calculation | Calculation result (in millions of yen/year) |

|---|---|---|

| In both the 4 degree scenario and the 2 degree limit scenario, as of 2030, physical damage from floods and storm surges increases due to intensified severe extreme weather events. We have a large number of ATMs nationwide and expect to have a significant financial impact from the increasing frequency of floods and storm surges. | The following items are estimated based on the Manual for Economic Evaluation of Flood Control Investment (Ministry of Land, Infrastructure, Transport and Tourism) and other references. ● Damage to ATM asset due to flooding ● ATM recovery cost ● Losses due to ATM shutdown

|

805~1,408 |

Seven Bank’s major initiatives

Responding to the potential impact of climate change risks and opportunities, the Seven Bank Group has been taking various actions to enable a decarbonized society.

Risk

| Risk type | Assessment item | Major initiatives | |

|---|---|---|---|

| Transiti- on risk |

Policy and regulations | Regulations on resource recycling |

Response for existing ATMs

● For ATMs, we have proactively introduced recycled materials and adopted an easy-to-maintain structure, etc. from the design phase. In the event of defects, we perform parts replacement and maintenance and make other efforts to extend its life.

● ATMs removed and collected due to renovation and closure of Seven-Eleven stores and replacement with fourth-generation ATMs are, if they are reusable machines, reused after maintenance, or reused as parts. ● Old unrecyclable ATMs are recycled as resources through recycling business operators. Thus, we achieve a recycling rate of around 100% for ATMs

Response for next-generation ATMs

● We proactively engage in collaboration with academia, etc. in view of exploration of new materials and research and development of recyclable materials for discussion of next-generation ATMs.

|

| Change in market | Change in raw material costs | ||

| Change in energy costs |

● To maintain an appropriate level of cash stored in ATMs, the usage patterns of each individual ATM are currently analyzed using AI technology and the timing of funds needing to be replenished is forecasted. Based on the information, optimal cash transportation routes and the frequency are determined in cooperation with a guarded money transport company. This enables efficient operation considering transportation-related energy consumption and CO2 emissions. ● Starting in 2022 with a data center which is powered by electricity solely from renewable sources, as well as a cloud storage service based on sustainable concerns, we are addressing future changes in energy costs, aiming to achieve complete zero emissions of CO2 by 2025. |

||

| Physical risk | Acute | Frequent and intensified extreme weather events |

● Although we established a structure to ensure business continuity traditionally by having our system bases in eastern and western Japan, in 2021, most core systems were transferred to cloud storage. In cooperation with our business partners, we continue to duplicate our systems and operate them alternately from our sites in eastern Japan and western Japan. At the same time, we have also stepped-up measures for early recovery in the event of failure, which includes rapid fault isolation and enhancing the remote maintenance environment. ● We take measures against blackouts due to disaster by installing an uninterruptible power supply (UPS) on the ATM itself. ● To minimize damage caused by natural disasters, we have established a system with Seven-Eleven to cooperate with the store management teams in the disaster area in advance and utilize the store information sharing system “7VIEW” to grasp the situation in real time and take early action. |

| Chronic | Rise in average temperature | ● Promoting casual office attire and reducing power consumption by heating and cooling equipment | |

Opportunity

| Type | Assessment item | Major initiatives | |

|---|---|---|---|

| Opportu- nity |

Product and services | Growing environmental awareness | ● Since the initial stage of development, the fourth-generation ATM model released in 2019 aimed to not only improve features and performance but also to contribute even better to society and the environment so as to meet broader customers’ and social needs. We successfully reduced power consumption by 40% in cooperation with our business partners through reconsideration of ATM circuit design and thorough selection of low power consumption parts. Currently, the fourth-generation ATMs are being gradually introduced nationwide and, replacing third-generation ATMs leads to reduced CO2 emissions. |

| Market | Need for cash in ordinary times/emergency situations |

● Assuming an increase of ATM replacements by financial institutions to minimize damages to bank branches and ATMs due to natural disasters, we strive for enhancing ATM services as a social infrastructure. ● In the event of a large-scale disaster that disables ATM operations over a wide area, we will dispatch mobile ATM vehicles to help the affected communities through the provision of settlement infrastructure. |

|

Risk Management

The Seven Bank Group incorporated climate change risks into the company-wide risk management system as part of the process of identifying and managing climate-related risks, as the section on the overall risk management policy in the “Basic Policy on Risk Control” requires the Bank to practice agile risk management by responding immediately to changes in the external and internal environment based on risk assessment results and monitoring.

Meanwhile, with regard to opportunities, the Sustainability Committee holds regular hearings on the status of efforts in each business unit to “reduce environmental impact,” which has been one of the priority issues up to now, and is strengthening cooperation with related divisions on further efforts to make ATMs more environmentally-friendly. We also cooperate with our business partners related to the ATM business and started discussions about establishing a sustainable ATM network.

Indicators and Target

Seven Bank is making strong efforts to reduce environmental loads, working toward achieving the target of “substantially no CO2 emissions associated with store operations” set in Seven & i Group’s environmental declaration “GREEN CHALLENGE 2050,” and calculate annual CO2 emissions volume in order to quantitatively understand environment loads. The CO2 emissions of the four dedicated offices of the Bank and three directly-managed Seven Bank ATM locations are shown on the right.

Taking into consideration expanding scope of our efforts to include consolidated subsidiaries in the future and enhancing cooperation with business partners for Scope 3, we plan to increase our efforts to reduce CO2 emissions.

[Scope]

● Four offices: Chiyoda-ku, Tokyo, Sumida-ku, Tokyo, Yokohama City, Kanagawa Prefecture, Toyonaka City, Osaka Prefecture

● Three directly-managed Seven Bank ATM locations: Shinjuku-ku, Tokyo, Minato-ku, Tokyo, Osaka City, Osaka Prefecture

(t-CO2)

| 2020 | 2021 | 2022 | ||

|---|---|---|---|---|

| Scope 1+2 | Indirect emissions from the use of electricity, heat, etc. supplied by others | 638 | 596 | 663※1 |

| Scope 3 | Categories 1, 5, 6, 7, 12, 13 and other※2 | 20,630 | 17,293 | 17,787 |

※1 CO2 emissions from the use of steam, hot water, and chilled water is included starting FY2022

※2 The category of other mainly includes CO2 emissions from the use of electricity by employees at home

Climate initiatives

- Seven Bank’s Sustainability

- Top Message

- Sustainability Management

- ESG

- Environment

- Social

- Corporate Governance

- Materiality

- Materiality top

- Social Contribution Activities

- For Future Generations

- Social Contribution Activities

- Other Corporate Information

- Investor Relations

- Company