Message from the President

We will continue to reinforce our income base to achieve our Medium-Term Management Plan, and promote the transformation to a business model with an eye toward the future.

Establishing and further deepening our Purpose

President and Representative Director

“We shape the future of everyday life by seeing your wishes and going beyond.” This company’s Purpose was set three years ago, in 2021. We had just entered the second founding phase, and we were looking to diversify our business while also reviewing and further strengthening existing businesses. At that point, the formulation of our Purpose was underpinned by our desire to once again tightly align the direction of our employees.

The Purpose explains what we care about and what we value in; First, we give shape to our customers' ideas without being bound by common practices or preconceived notions, aiming to achieve "first" in the industry, Japan, and the world.

Second, we place importance on continuing to tackle challenges to create a new daily life for our customers.

Both the company and its business endeavors require continuous challenge and innovation if they are going to grow.

By accumulating small successes toward realizing our Purpose, we hope to contribute to resolving social issues and create a new world that we previously could not have imagined.

Once we formulated our Purpose, we worked to ensure that each workplace, or each individual employee, would make it a “personal” matter. I have had a couple of times to communicate directly with many employees through occasions such as town hall meetings, and I have realized that each and every one of them has great passion toward their work. For example, people who work in administrative division suggest proactively promoting the digital transformation (DX) of operations, and our sales force is evolving from simply selling products to providing consulting services as a business partner that identifies and resolves customer issues. I assume now that many employees have tied the Purpose to their work so that they recognize their own Purpose and are aiming for higher levels of performance.

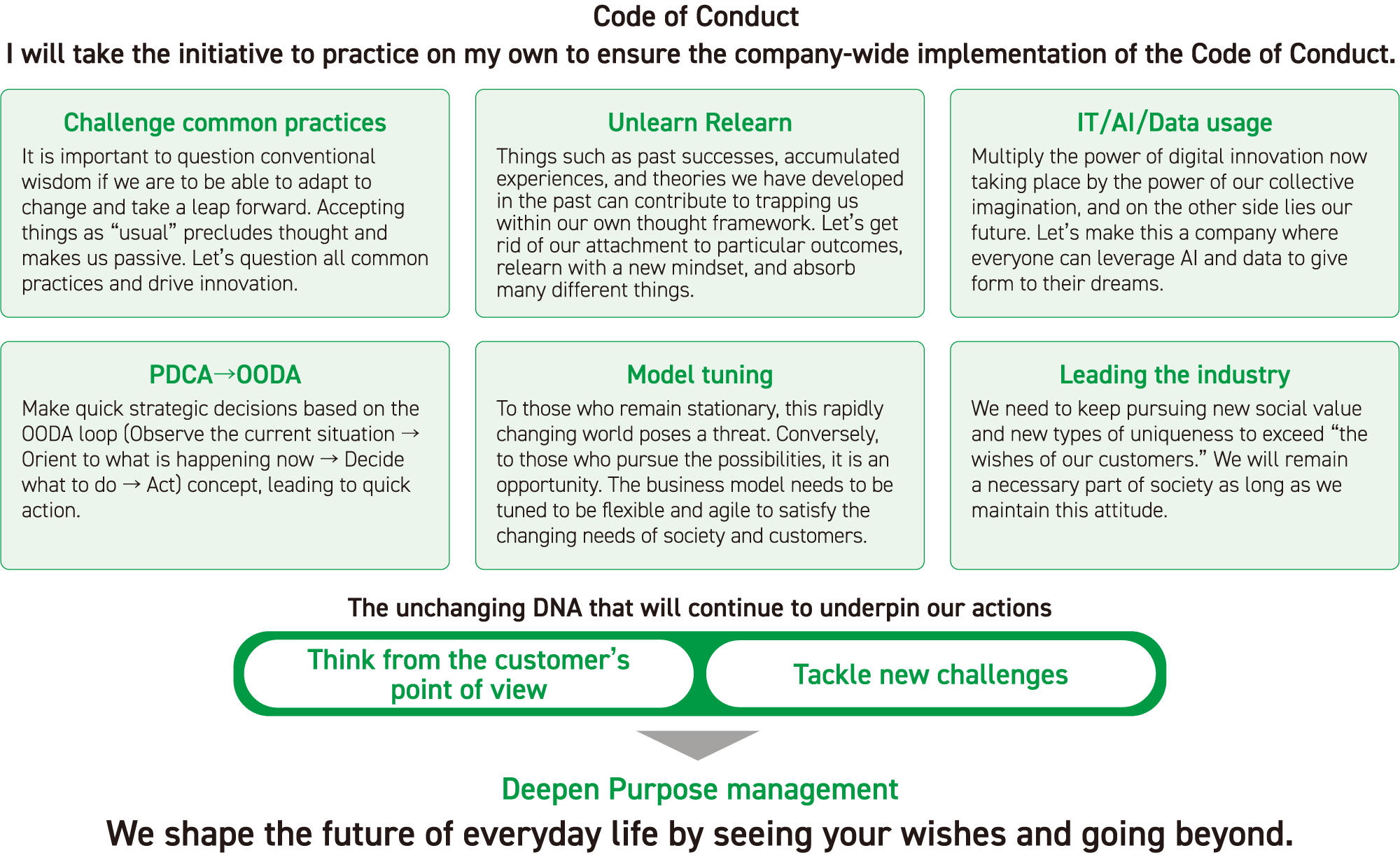

The next step, on which we are now focusing, is to further refine our thoughts and approach to achieving our Purpose. To this end, I clarity code of conduct consisting of 6 items including “Challenge common practices” and “Unlearn Relearn,” which encourages employees to let go of their attachment and learn anew. Now I am working to ensure the company-wide implementation of it. By merging them with the DNA we inherited from Seven-Eleven—“think from the customer’s point of view and tackle new challenges”—we intend to further deepen Purpose management.

Overview of FY2023 and outlook for FY2024

In FY2023, in addition to steady existing business expansion, our acquisition of Seven Card Service Co., Ltd. as a subsidiary in July 2023 led to a significant 27.6% YoY increase in consolidated ordinary income and a 5.5% YoY increase in consolidated ordinary profit. Due to robust funding demand, growth in the number of ATM transactions enabled Seven Bank to post a new high in non-consolidated ordinary income, but investments in the replacement of ATMs with new models and new banknotes resulted in a decline in ordinary profit.

For FY2024, both consolidated and non-consolidated ordinary income are expected to rise, but the company projects a decline in ordinary profit. Seven Bank on a non-consolidated basis is expected to see increased income due to growth in the number of ATM transactions, and Seven Card Service is also expected to contribute to the results for the full year. Meanwhile, factors in the projected decrease in profits include depreciation associated with the replacement of ATMs with new models reaching its peak and continued growth investment.

Future business strategy

Our ATM platform strategy remains the pillar of our future growth strategy. We believe that the strengths of our ATM business lie in our stance of constant building of functions and services from scratch on a customer-oriented basis, and restructuring of everything using IT. We have thoroughly disassembled the elements of existing ATMs and introduced new services and functions from the customer’s point of view, while at the same time eliminating unnecessary functions. We have always been a step ahead in terms of delivering a new generation of ATMs to the market.

It is very important to employ foresight and invest boldly. We envisioned one of the major enhanced functions called plus area, for instance, which is included in our fourth-generation ATMs launched in 2019, from the conception stage in 2016 to provide an identity verification function, ensure digital safety, and replace administrative functions, including support for Individual Number Cards.

We have designed the 27,000 ATMs nationwide in such a manner that software is all that is required to adapt to the new banknotes. This advance investment came to life in the form of +Connect, which we launched in September 2023. +Connect is a business concept that transitions away from the ATM as a conventional cash payment platform, integrating the functions of identity verification document reading and facial recognition to offer new services and customer experiences.

In the short term, our focus is on the host of procedures and other over-the-counter services that have been offered by financial institutions; in the long term, our vision is to make ATMs a one-stop provider of all procedures and identity verifications that have been traditionally been conducted in person, including at counters of municipalities and other administrative agencies.

In the retail business, we aim to maximize synergies by leveraging 7iD, the Seven & i Group’s common membership platform. 7iD currently boasts over 30 million members. Linking this individual retail purchase data with bank accounts, credit cards, electronic money, and other financial data should enable us to utilize the data for digital marketing and credit, as well as in developing new financial services. Together with Seven Card Service, which we made a subsidiary in July 2023, we plan to issue a new credit card with unique product features that capitalize on the characteristics of retail and finance.

We have positioned our overseas business as one of the company’s growth drivers, and in addition to Indonesia, the Philippines, and the U.S.—the three countries in which we had already been doing business—we newly established a local subsidiary in Malaysia in May 2024. In the U.S., we will renew our agreement with 7-Eleven, Inc. in July 2024 and will establish an ATM network of approximately 11,600 ATMs, including 3,000 new units at Speedway stores starting in FY2025. Business in Indonesia and the Philippines has also been robust. In Indonesia, the number of ATMs has reached 8,000 and in the Philippines, placement in local 7-Eleven stores has been completed, and the next phase of the plan is to proceed with the installation of ATMs in local supermarkets. New financial services through ATMs are being developed in both countries. We are in the process of transforming ourselves from a so-called ATM operator into a financial services provider linked to retailers.

The company will promote the +Connect strategy and transform the ATM into a new platform on which all conceivable procedures can be performed.

Use of human capital and DX strategy

We refer to them as “human capital” rather than “human resources,” because I believe they are the source of our competitive advantages and absolutely the main characters in realizing our Purpose. My focus in human capital development is on our people honing their ability to grasp change, using their imagination, and creating new things. I believe that the best way to realize this is to properly complete each task and issue. Through this process, we will each achieve personal growth and move forward to tackle the next challenge. My view is that fostering such a culture is a basic element of our human capital strategy.

Part of our management ethos reads, “We act to promptly introduce the benefits of technical innovation and pursue self-development.” For this reason, we have a variety of programs to aid all employees in using technology and applying it in their business endeavors. Participants in our Data Management Office (DMO), for instance, which aims to use data to transform business models and processes, currently number about 330 people, or almost half of our employees. Many employees also voluntarily participate in the “Data Science Program” and “App Development Training,” in which they can enroll according to their individual skills, and participants have achieved results in the performance of their actual duties.

Going forward, the utilization of AI and data will be required across all operations. Executing DX strategy is also essential to our growth. We are promoting DX internally by preparing an environment where digital tools are available company-wide, offering these opportunities to everyone regardless of business domain, and having staff members who will support throughout the process. With regard to the personnel system, we have established a specialist system to focus on talent development in IT and other such specialized fields, and have launched a scheme that facilitates employees playing active roles and rewards them in the form of compensation. With several initiatives, as mentioned before, running in parallel, I can see that an organization culture is beginning to develop where employees enjoy learning IT skills and proactively seek out new challenges to tackle with these skills.

Sustainability initiatives

Although we had not utilized the word “sustainability” since our founding, we have conducted our corporate activities with the objective of balancing our business endeavors against our quest to realize social and environmental value. And the formulation of the Purpose in 2021 has helped us to clarify what our company stands for and what our most important values are. Today, we are positioning sustainability as the core of our long-term management strategy and, in line with our five material issues, are accelerating initiatives to address environmental and social issues through our main business.

In the ATM business, in addition to the convenience of having ATMs available for use 24 hours a day, 365 days a year at a nearby convenience store, the large-sized screen, simple operation, and strong security also facilitate use. We believe that we can play a role in resolving social issues by providing services that are easy for everyone to use, regardless of age or nationality.

Moreover, we are confident that, going forward, we will be able to support financial institutions and government agencies to streamline their counter services by our ATMs. These initiatives should redouble our contribution to society by streamlining not only convenience and operability of ATMs, but also various types of operations through ATMs.

Additionally, with regard to global environmental initiatives, our ATMs contribute to the DX for banking and administrative operations, thereby promoting the elimination of paper usage. We are also attempting to mitigate greenhouse gas emissions by heightening logistics efficiency during cash transportation. Meanwhile, I understand that there are remaining issues to work on, such as the development of equipment and services that people with disabilities and foreign residents in Japan can easily use.

Going forward, we will focus on promoting sustainability, with the aim of becoming “society’s most friendly digital channel” as well as “the most environmentally friendly ATM network.”

I will continue to lead our employees and to be innovative by taking my own initiatives and continuing to learn.

Attitudes and values that are important as a leader

Above all, as head of the company, I am always mindful of taking the initiative. Whenever I attempt something new, I dive in before anyone else and be sure to work with those who are willing and able to follow. I adopted this approach when setting up Seven Labo, a department responsible for promoting new businesses and collaborating with other companies. I also established a corporate transformation department by personally entering the domain of AI utilization and data science and banding with my team to take on the challenges.

It is also important to continue learning. If we are going to exceed the wishes of our customers, we must continually update our own skills and knowledge. Failure to do so will prevent us from keeping pace with the speed of change and creating services beyond what our customers anticipate. In my private time, I am now learning to edit images using generative AI. With consideration for the future, I feel the need to transform myself in order to adapt to generative AI. That's why I'm currently taking on this challenge in my private life. I also maintain an attitude of openness and equality and to actively disseminate information. Through company-wide morning assemblies and town hall meetings, I regularly communicate this attitude to employees.

In my experience, projects have been more successful when there have been large numbers of people opposing them. I believe that it is because of that very diversity of opinions that, through discussion, I have succeeded in navigating obstacles and difficulties together with my colleagues, and I hope to continue to innovate in this way going forward.

As with the +Connect strategy, the aim of which is to cover all over-the-counter services, I always try to dream big. But the important thing is to execute methodically, one step at a time. The accumulation of small success stories leads to individuals gaining confidence and the subsequent improvement in the level of individual work will lead to the further development of the business. The Seven Bank Group will work in a unified manner, moving one step at a time, to tackle the challenge of realizing our Purpose. And in a few years, we want to have become so innovative that people will say, “That’s the company that used to be a bank.”

- Management information

- Message from the President

- Management Policy, Management Environment, and Issues to be Addressed,etc.

- Risk Factors

- Risk Management Initiatives

- Compliance Initiatives

- Medium-Term Management Plan FY21-FY25

- Stock and bond information

- Stock Information

- Dividends and Shareholders Returns Policy

- Corporate Bond and Rating Information

- General Meeting of Shareholders

- IR Library

- IR News

- Financial Statements

- IR Presentations

- IR Calendar

- Annual report

- Seven Bank Disclosure Policy

- Other Corporate Information

- Company

- Sustainability