- Basic Views

- Initiatives to Strengthen Corporate Governance

- Evaluation of effectiveness of the Board of Directors

- About Outside Officers

- Policy on Compensation of officers and Compensation System for officers

- Internal Audit and Audit by Audit & Supervisory Board Members

- Status of Improvement and Operation of the Internal Control Systems

-

Policy on Governance related to Listed Subsidiaries

(Protection of Rights of Minority Shareholders)

Basic Views

Corporate Governance

As a bank that owns and operates an ATM network that manages deposits from a large number of customers and has a nature similar to that of public infrastructure, the Bank recognizes that ensuring disciplined corporate management is vital in responding to social trust and seeks to ensure effective corporate governance. This is achieved by maintaining and improving corporate governance and compliance systems to ensure transparent, fair and swift managerial decision making; clarifying the roles and responsibilities of executives and employees; strengthening management oversight functions; and ensuring equitable operations. The Bank adopts the organizational form of a Company with Audit & Supervisory Board. At the Board of Directors, the Bank ensures effective corporate governance through decision making by Directors with executive authority over operations who are well versed in the Bank’s operations and Outside Directors who have considerable experience and insight in their areas of expertise as well as through audits by the Audit & Supervisory Board Members.

■ Corporate Governance Guidelines

In order to put the Basic Policy on Corporate Governance into practice, we have established the Corporate Governance Guidelines to clarify what we should do specifically and to fulfill our accountability to shareholders.

■ Corporate Governance Report

We submit a Report on Corporate Governance describing our corporate governance system to the Tokyo Stock Exchange and post it on our website.

Corporate Governance System Overview

■ Independence of Officers

■ Main Items and Descriptions

■ Corporate Governance Structure

- ①Board of Directors

-

Number of Meetings held during FY202315times

Average attendance rate98.0%

The Bank’s Board of Directors has consisted of eight Directors, including five Independent Outside Directors. The Board of Directors meets, in principle, once a month to decide the Bank’s basic management policies and important operational issues and to supervise the execution of duties by Directors with executive authority over operations and Executive Officers.

- Major agendas

-

- ・Management policies and plans to achieve the Medium-Term Management Plan

- ・Sustainability promotion plan

- ・M&A

- ・Revision of the Charter of Ethics

- ・Group engagement

- ・Subsidiary investment/impairment loss

- ②Nomination & Compensation Committee

-

Number of Meetings held during FY20237times

Average attendance rate100%

As an advisory body to the Board of Directors, the Bank has established the Nomination & Compensation Committee, chaired by an Independent Outside Director in order to supplement functions of the Board of Directors. The committee is delegated by the Board of Directors to recommend candidates for Director to be put on the agenda at a General Meeting of Shareholders, to recommend candidates for Executive Officer to be put on the agenda at a Board of Directors meeting, and to supervise a plan on successors to the position of Director, etc.

- ③Audit & Supervisory Board

-

Number of Meetings held during FY202314times

Average attendance rate100%

The Bank’s Audit & Supervisory Board has consisted of four Audit & Supervisory Board Members, including two Independent Outside Audit &Supervisory Board Members. The Audit & Supervisory Board meets, in principle, at least once a month to receive reports regarding important auditing-related issues and deliberate and make decisions thereof. The Audit & Supervisory Board convenes with Representative Directors, the Internal Audit Division and the Accounting Auditor on a regular basis to exchange opinions and make requests as necessary on issues to be addressed by the Bank, the status of improvements to the Audit & Supervisory Board Members’ auditing environment and important auditing-related issues.

- ④Executive Committee

-

Number of Meetings held during FY202362times

In principle, the Executive Committee meets on a weekly basis to deliberate the execution of important operations, including business plans; acquisition and disposal of assets; credit provision-related issues; borrowing of money and payment of expenses; credit management issues; rewards and sanctions for employees; issues related to employees’ working conditions and benefits; the establishment, change and abolition of the organization; and the formation, revision and elimination of rules and regulations, in addition to conferring on issues to be deliberated at the Board of Directors meetings in advance. The Bank has adopted an executive officer system, and the Executive Committee comprises Executive Officers and others nominated by the Board of Directors.

Initiatives to Strengthen Corporate Governance

For the sustainable growth and the improvement of corporate value, the Bank has positioned strengthening governance as a key management issue. In FY2023, with new Outside Directors and a new Outside Audit & Supervisory Board Member added, we have enhanced the independence of the Board of Directors, and have put our effort in making the Board of Director more effective with the Board of Directors composed of diverse members. Please note that the Company set the basic views, the framework, and the operation policy that need to be addressed to enable the effective corporate governance in its Corporate Governance Guidelines, and released it on our website.

Evaluation of effectiveness of the Board of Directors

The Seven Bank has conducted “evaluation of effectiveness of the Board of Directors” since FY2015. In FY2023, a questionnaire survey was anonymously conducted for Directors and Audit & Supervisory Board Members about the operation of the Board of Directors, the composition of the Board of Directors, agenda items of the Board of Directors and other items. The results were deliberated at the Board of Directors.

Results of the evaluation for FY2023

The Bank’s Board of Directors has been fulfilling both its decision-making and supervisory functions as all Directors and Audit & Supervisory Board Members share its roles and responsibilities and conduct deliberations from diverse perspectives through free and open discussions based on the members’ respective knowledge and expertise. Thus, it was confirmed that the Board of Directors has been operating appropriately, thereby ensuring its effectiveness. Details of initiatives concerning the priority matters are as follows.

| Priority matters for FY2023 | Details of initiatives in FY2023 |

|---|---|

| Advance governance in the Seven Bank Group | Newly appointed Outside Directors and Audit & Supervisory Board Members to ensure diversity among the members of the Board of Directors. Accelerated provision of reference materials and changed their contents for deeper understanding of agenda items. |

| Enhance opportunities for exchange of views and interaction with executive personnel. | Regularly conducted opinion exchanges with executive personnel who are closer to front-line work, for example, newly appointed General Manager or President of the Group companies giving business briefing. All Outside Directors served as judges for the Purpose Award, where our employees present their initiatives aligned with the Company’s Purpose. |

| Activities for constructive dialogues with shareholders and investors | Proactively shared Company’s and the Seven & i Holdings Co., Ltd.’s financial situation and investors responses at the meetings of the Board of Directors. |

Priority matters for FY2024

-

①Advance governance in the Seven Bank Group

Advance monitoring function and enhance discussion from a risk point of view, promote more diversity in composition and executive personnel -

②Enhance broad and strategic discussion

Share the awareness of the issues in the medium- to long-term viewpoint and engage in discussions of growth strategies, share the status of dialogues with shareholders and investors with the Board of Directors, and hold strategic discussions in light of the voices of the capital market -

③Ensure continuity of opportunities for exchange of views and interaction with executive personnel

Provide opportunities for briefing on operations and information sharing by executive personnel, and organize opportunities for exchange of views and interaction with executive personnel

About Outside Officers

Independence Standards for Outside officers

The Bank’s Independence Standards for Outside Officers are as follows.

- (1)Is not a person with executive authority over operations of the Bank’s parent company or fellow subsidiary (or has been in such position in the past; hereinafter, the same applies to each item);

- (2)Is not a person for which the Bank is a major business partner or a person with executive authority over such entity’s operations, or a major business partner of the Bank or a person with executive authority over such entity’s operations;

- (3)Is not a consultant, an accounting professional, a legal professional or a person belonging to an organization that receives a significant amount of monetary compensation from the Bank, other than officers’ compensation;

- (4)Is not a major shareholder of the Bank or a person with executive authority over operations of such shareholder; or

- (5)Is not a close relative of a person that falls under any of the above or a relative by blood or marriage within the second degree to a person with executive authority over operations of the Bank.

Other matters concerning Independent Officers

The Bank registers all persons who fulfill the qualifications of Independent Officers, as well as the Independence Standards for Outside Officers, as Independent Officers.

Reasons for Appointment of Outside Officers

| Name | Reasons for Appointment | |

|---|---|---|

| Outside Directors | Makoto Kigawa | Mr. Makoto Kigawa’s experience and insight in corporate management at YAMATO HOLDINGS CO., LTD., etc., have genuinely contributed to the Bank’s management. |

| Yukiko Kuroda | Ms. Yukiko Kuroda’s experience as a corporate manager and insight related to developing human resources who can handle global business have genuinely contributed to the Bank’s management. | |

| Etsuhiro Takato | Mr. Etsuhiro Takato’s experience and insight in corporate management, marketing, and global duties at Ajinomoto Co., Inc. have genuinely contributed to the Bank’s management. | |

| Yuji Hirako | Mr. Yuji Hirako’s experience and insight in corporate management at ANA HOLDINGS INC., etc. have genuinely contributed to the Bank’s management. | |

| Tami Kihara | Ms. Tami Kihara’s experience and insight in corporate management at Ricoh IT Solutions Co., Ltd. and human resource strategy at Ricoh Company, Ltd. have genuinely contributed to the Bank’s management. | |

| Outside Audit & Supervisory Board Members | Hideaki Terashima | Mr. Hideaki Terashima’s broad insight into corporate legal affairs, nurtured in his career as an attorney-at-law, has genuinely contributed to audits of the Bank’s management. |

| Chieko Ogawa | Ms. Chieko Ogawa’s international insight nurtured in her career as a Certified Public Accountant has genuinely contributed to audits of the Bank’s management. | |

Support Systems/Training Policies for Outside Officer

- 1.Provide necessary and sufficient internal systems for enabling Directors and Audit & Supervisory Board Members to fulfill their roles and responsibilities in an effective manner.

- 2.Provide Directors and Audit & Supervisory Board Members with necessary opportunities to enable them to fulfill their roles, such as by providing the information and knowledge relating to the business activities that would be necessary to supervise corporate management when they take office and continually thereafter.

- 3.Build systems for sharing a sufficient amount of the Bank’s internal information with Outside Directors and Outside Audit & Supervisory Board Members (hereinafter referred to as “Outside Officers”).

- 4.Encourage Outside Officers to deepen their understanding of the Bank’s management ethos and corporate culture, while providing information on the Bank’s business environment and other issues on a continuous basis.

- 5.Maintain and improve the environment for Outside Officers to mutually share information and exchange ideas, such as by holding periodic meetings with Executive Officers and/or other Non-Executive Officers.

- 6.Bear the expenses for Outside Officers to fulfill their roles.

Roles and expertise of Directors and Audit & Supervisory Board Members

We believe that the role of Directors and Audit & Supervisory Board Members is to realize appropriate business management by supervising and auditing business execution while fully understanding the social responsibilities and mission of the banking business. In order to properly fulfill this role, we utilize the skill matrix when appointing Directors and Audit & Supervisory Board Members, and aim for a well-balanced composition of members with diverse skills and expertise.

| Position | Name | Corporate Management |

Sales and Marketing |

Product Development & IT |

Global | Human Resources & Labor |

Financial Affairs and Finance |

Legal Affairs & Risk Management |

|---|---|---|---|---|---|---|---|---|

| Outside Director (Independent Officer) | Makoto Kigawa | 〇 | 〇 | 〇 | 〇 | |||

| Outside Director (Independent Officer) | Yukiko Kuroda | 〇 | 〇 | 〇 | ||||

| Outside Director (Independent Officer) | Etsuhiro Takato | 〇 | 〇 | 〇 | ||||

| Outside Director (Independent Officer) | Yuji Hirako | 〇 | 〇 | 〇 | ||||

| Outside Director (Independent Officer) | Tami Kihara | 〇 | 〇 | |||||

| Director | Tsuyoshi Kobayashi | 〇 | 〇 | 〇 | ||||

| Chairman and Representative Director | Yasuaki Funatake | 〇 | 〇 | 〇 | 〇 | |||

| President and Representative Director | Masaaki Matsuhashi | 〇 | 〇 | 〇 |

| Outside Audit & Supervisory Board Member (Independent Officer) | Hideaki Terashima | 〇 | 〇 | |||||

|---|---|---|---|---|---|---|---|---|

| Outside Audit & Supervisory Board Member (Independent Officer) | Chieko Ogawa | 〇 | ||||||

| Full-time Audit & Supervisory Board Member | Kazuhiko Ishiguro | 〇 | 〇 | |||||

| Full-time Audit & Supervisory Board Member | Ryoji Sakai | 〇 | 〇 | 〇 |

Policy on Compensation of officers and Compensation System for officers

Seven Bank’s “Policy on Compensation of Officers and Compensation System for Officers” were, excluding compensation for Audit & Supervisory Board Members, proposed to the Board of Directors by the Nomination & Compensation Committee, and determined with a resolution of the Board of Directors as follows:

1 Basic Policy on Compensation of Officers

The Bank decides compensation of officers based on the following points.

- (1)Ensuring a compensation system to promote sustainable improvement of corporate value with emphasis placed on the link to business performance

- (2)Ensuring compensation systems and compensation levels with their responsibilities to secure highly capable human resources who lead and take responsibility for, in an appropriate manner, the supervision and execution of operations

- (3)Ensuring a compensation system based on an objective and transparent process, and that is fair and equitable

2 Method for Determining Compensation, etc. for Individual Officers in the Fiscal Year under Review

The Bank has established a Nomination & Compensation Committee, comprising a total of four members made up of two Independent Outside Directors and two Representative Directors, chaired by an Independent Outside Director, as an advisory body to the Board of Directors (as of the end of the fiscal year under review)*. The Nomination & Compensation Committee proposes specific amounts of compensation, etc. to be granted to Directors within the range of the total amount approved at the General Meeting of Shareholders, for determination by resolution of the Board of Directors. From the perspective of understanding the process of discussion, Audit & Supervisory Board Members may participate as observers who do not possess voting rights, when a Nomination & Compensation Committee meeting is held. The procedure is stipulated in the Regulations for Officers, which is modified, amended, or abolished by a resolution of the Board of Directors upon discussion with

the Audit & Supervisory Board Members.

Compensation, etc. for Audit & Supervisory Board Members is determined upon discussion by the Audit & Supervisory Board Members within the range of the total amount approved at the General Meeting of Shareholders.

- ※The Nomination & Compensation Committee consists of a total of five members: three Independent Outside Directors and two Directors as of July 1, 2024.

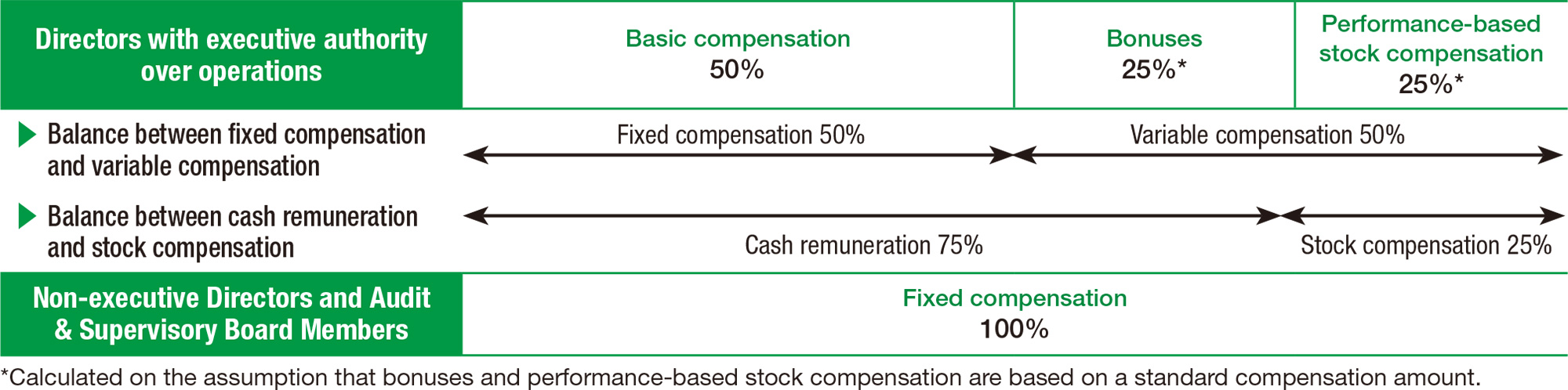

3 Compensation Structure

The Bank’s compensation structure for officers comprises “basic compensation” as fixed compensation and “bonuses” and “performance-based stock compensation” as variable compensation, which are applied as follows.

| Fixed compensation | Variable compensation | ||

|---|---|---|---|

| (a)Basic compensation | (b)Bonuses | (C)Performance-based stock compensation | |

| Directors with executive autlority over operations | ● | ● | ● |

| Non-executive Directors | ● | ー | ー |

| Audit & Supervisory Board Members | ● | ー | ー |

Each plan is positioned as follows.

| (a)Basic compensation | Compensation aiming to encourage steady execution of duties commensurate with job rank |

|---|---|

| (b)Bonuses | Short-term incentives aiming to steadily achieve performance targets (milestones) for each fiscal year for the medium-to long-term improvement of corporate value |

| (C)Performance-based stock compensation | Medium-to long-term incentives for the medium-to long-term improvement of corporate value, aligning interests with shareholders |

The ratio of each plan has been decided as described below by a resolution of the Board of Directors upon a proposal by the Nomination & Compensation Committee. Factors taken into account included a balance between fixed compensation and variable compensation, a balance between cash remuneration and stock compensation, and a balance between bonuses and stock compensation, which are incentives to execute management with a well-balanced perspective in both the short-term and the medium- to long-term (excluding compensation for Audit & Supervisory Board Members).

In addition, non-executive Directors and Audit & Supervisory Board Members receive only fixed compensation, as their role is to supervise the Bank’s management from an objective and independent standpoint.

4 Compensation Level

To provide a competitive compensation level and thereby secure highly capable human resources, the Bank’s compensation level for officers has been determined by a resolution of the Board of Directors based on the proposal made by the Nomination & Compensation Committee. The deliberation was based on the analysis and comparison of data on the compensation levels of a group of companies of the same size and operating in the same industry as the Bank, which has been drawn from a larger body of objective data on compensation levels provided by an outside professional organization (excluding compensation for Audit & Supervisory Board Members).

5 Details and Method of Calculation of Variable Compensation

- ・Bonuses

- Bonuses, which are provided as short-term incentives, will be determined by multiplying the standard amount of compensation for each job rank by performance-linked factors corresponding to the achievement of consolidated performance targets for the previous fiscal year.

- ・Performance-based stock compensation

- Performance-based stock compensation, which is provided as a medium- to long-term incentive, is composed of a “fixed portion,” which grants fixed points for each job rank, and a “performance-based portion,” which grants a varying number of points determined by job rank and performance. For each portion, points are granted and accumulate every year of the term of office of the relevant officer, and a number of the Bank’s shares corresponding to the amount of accumulated points will be delivered to the officer upon retirement.

The number of points (i.e., the number of shares to be delivered) to be provided in the performance-based portion will be determined by multiplying the number of points for each rank by performance-linked factors according to the achievement level of consolidated performance targets.

In addition to the existing malus clause, the Bank has introduced a clawback clause that allows the Bank to require Directors to repay performance-based stock compensation in the event of falling under certain circumstances such as gross negligence or fraud in relation to financial results, material revision of financial results, or violation of law or regulation. Compensation that may be subject to repayment is performance-based stock compensation received as compensation for the fiscal year in which the relevant circumstances arose and the three preceding fiscal years. This provision applies to performance-based stock compensation granted as compensation for the fiscal year ended March 31, 2024 and all periods thereafter. - ・Evaluation indicators for variable compensation (performance indicators) and evaluation method

- Consolidated ordinary income and consolidated ordinary profit are used as the evaluation indicators to take account of both sales size and profitability aspects with a good balance. Additionally, employee engagement was added as an evaluation indicator to be reflected by the performance-based stock compensation points granted for the fiscal year ended March 31, 2024 and thereafter.

| Plan | Indicators and evaluation method | |

|---|---|---|

| Bonuses |

|

|

| Performance- based stock compensation | Fixed portion | ー |

| Performance- based portion |

|

|

Targets and Results of Evaluation Indicators for Variable Compensation

Fiscal year under review (from April 1, 2023 to March 31, 2024)

| Evaluation indicators | Target value (Millions of yen) | Result (Millions of yen) | Degree of target achievement (%) |

|---|---|---|---|

| Consolidated ordinary income | 198,500 | 197,877 | 99.7 |

| Consolidated ordinary profit | 25,500 | 30,526 | 119.7 |

| Evaluation indicators | Score in March 2023 | Score in March 2024 | Year on Year |

|---|---|---|---|

| Employee engagement | 68 | 69 | +1 |

- ※Of the evaluation indicators, those for employee engagement are expressed as an index representing the results comparing the total scores for the employee engagement survey conducted in March 2023 and March 2024.

Internal Audit and Audit by Audit & Supervisory Board Members

① Cooperation between Audit & Supervisory Board Members and the Accounting Auditor

Audit & Supervisory Board Members and the Accounting Auditor hold regular meetings to exchange opinions and promote mutual cooperation, based on the audit contract with KPMG AZSA LLC. Audit & Supervisory Board Members perform audits on the execution of duties by Directors by attending the Board of Directors meetings or other means. In addition to conducting their own operational and accounting audits, Audit & Supervisory Board Members receive reports on results of external audits by the Accounting Auditor, and check the appropriateness thereof. Members from the Internal Audit Division are also present when receiving accounting audit reports from the Accounting Auditor, in an effort to facilitate close cooperation.

② Cooperation between the Audit & Supervisory Board Members and Internal Audit Division

The Bank has in place the Internal Audit Division, which is independent of the Bank’s other departments engaging in business operations and directly reports to the President and Representative Director.

The Internal Audit Division annually sets a basic policy for internal auditing plans and priority issues to be addressed, which are to be approved by the Board of Directors. Individual internal auditing plans are formulated by the General Manager of the Internal Audit Division, and approval of these plans is obtained from the President and Representative Director, who is the officer in charge of the Internal Audit Division. Individual internal audits are conducted by investigating and evaluating the appropriateness and effectiveness of internal management systems as a whole based on the following items to discover problems, if any, and suggest how to address them. The results of these audits are reported to the President and Representative Director,

the Executive Committee, the Board of Directors, and the Audit & Supervisory Board.

- AStatus of business plans

- BCompliance system and compliance status

- CAppropriateness and effectiveness of internal controls over financial reporting

- DSystems for and the current status of customer management, including customer protection

- ESystems for and the current status of risk management

- FInternal management systems at each operational department and appropriateness and effectiveness thereof

Internal audits are conducted on all the Bank’s departments and systems, including those of its subsidiaries. Audits are also conducted on the operations of the Bank’s major outsourcing contractors regarding the status of management by its relevant internal departments, as well as on the outsourcing contractors themselves, within the scope agreed with them. Audit & Supervisory Board Members receive periodic reports from the Internal Audit Division on its audit plans and results, and request investigations as necessary to ensure that the audit results of the Internal Audit Division are effectively utilized for internal control system audits by Audit & Supervisory Board Members. In addition, Audit & Supervisory Board Members receive reports on the status of internal control systems regularly or as necessary from the departments in charge of internal control functions, and ask for detailed explanations as necessary.

Status of Improvement and Operation of the Internal Control Systems

Concerning the system upgrades stipulated in Article 362, Paragraph 4, Item 6 of the Companies Act, the Board of Directors made a resolution on May 8, 2006, on matters to be implemented by the Bank. Progress of the details of this resolution is reviewed each fiscal year. In line with this resolution, Seven Bank strives for good corporate governance and internal control, while ensuring appropriateness in the Seven Bank Group’s operations.

Policy on Governance related to Listed Subsidiaries

(Protection of Rights of Minority Shareholders)

Seven & i Holdings Co., Ltd., the Bank’s parent company, aiming to become a worldwide top-class retail group centered on “food,” operates domestic convenience store operations with Seven-Eleven at its core, overseas convenience store operations, superstore operations, financial services, etc. Seven Bank operates, with financial services at its core, ATM platform business, banking business, credit card and electronic money businesses, etc. Although Seven & i Holdings’ financial services includes not only the Company and its subsidiaries, but also Seven Financial Service Co., Ltd., and Seven CS Card Service Co., Ltd., their services and target customers are different from ours, and therefore we consider that our clear business demarcation is and will be ensured. As business segments clearly differ between the parent company group and the Company, we believe that we are in the position where we can grow together with the parent company group through developing unique retailor-specific financial services mainly for customers visiting the parent company group stores.

Guidelines on Measures to Protect Minority Shareholders in Conducting Transactions with a Controlling Shareholder

Seven & i Holdings Co., Ltd. is the Bank’s parent company, indirectly holding 46.43% of its voting rights, and therefore falls under the category of controlling shareholder stipulated in the Timely Disclosure Rules. When conducting transactions, etc., with the parent company, the Bank will comply with the arm’s-length rule under the Banking Law, which is a rule established to prevent the soundness of the Bank’s management from being compromised through conflict-of-interest transactions. The Bank fully confirms the necessity for such transactions and that the conditions of such transactions do not differ significantly from conditions of usual transactions with third parties. The transaction for the acquisition of shares of Seven Card Service Co., Ltd. from Seven Financial Service Co., Ltd., a wholly-owned subsidiary of Seven & i Holdings Co., Ltd., conducted in 2023 fell under a transaction with a controlling shareholder. Accordingly, the Bank set up a special committee to discuss and determine the validity of the transaction conditions and the fairness of the procedure in order to ensure the benefit of minority shareholders following the “Fair M&A Guidelines.” The committee thoroughly discussed from an independent standpoint at a different level from the Board of Directors and finally made a decision. If another material case similar to the above arises, the Bank will pay full attention to protecting the benefit of our minority shareholders by setting a special committee.

Relationship with Parent Company, Seven & i Holdings Co., Ltd.

The Bank believes that in order to achieve sound and sustainable growth, it is essential to engage in business development (innovation) by integrating collaboration with various partners to an advanced degree based on our credibility and transparency of management as a corporate entity. Furthermore, we recognize that listing on the market is one of the most effective ways to ensure the Bank’s credibility and transparency of management. As an independently listed company, the Bank independently and autonomously deliberates and determines our own business strategies, personnel policies, capital policies, etc., as we engage in our own operating activities. In addition, in order to ensure the necessary independence from our parent company, the Bank has also appointed Independent Outside Directors and Independent Outside Audit & Supervisory Board Members, who provide supervision to ensure that no conflicts of interest arise between our parent company and shareholders other than the parent company. The Bank does not have any agreements concluded regarding group management with the parent company. Furthermore, we have established the Nomination & Compensation Committee chaired by an Independent Outside Director as an advisory body to the Board of Directors. This Committee deliberates on matters concerning recommendations of candidates for Director and Executive Officer, thereby ensuring independence from our parent company in the appointment of top management. In addition, to comply with the disclosure obligations, etc., of the parent company, the Bank has established the Guidelines for Reporting of Material Facts with the parent company and reports to the parent company accordingly. These reports are limited to matters that impact the parent company’s timely disclosure, materially impact the parent company’s consolidated financial statements, and may potentially impair the credibility of the Seven & i Group.

The parent company’s approach and policy regarding group management are as follows.

“Although the Company owns the listed subsidiary, Seven Bank, Ltd., the ATM platform business and banking operations conducted by this entity and its subsidiaries do not overlap with the core operations of other Group companies, ensuring clear business demarcation. From the standpoint of respecting the independence of its listed subsidiaries, the Company values the management decisions of said company, and respects the independent and autonomous deliberation and determination of its business strategies, personnel policies, and capital policies, as it engages in its operating activities.” (Quoted from the website of Seven & i Holdings Co., Ltd.)

- Seven Bank’s Sustainability

- Top Message

- Sustainability Management

- ESG

- Environment

- Social

- Corporate Governance

- Materiality

- Materiality top

- Social Contribution Activities

- For Future Generations

- Social Contribution Activities

- Other Corporate Information

- Investor Relations

- Company