Individual InvestorsWe shape the future of everyday life by seeing your wishes and going beyond

Seven Bank’s Operating System

Seven Bank provides a unique financial service that is close, convenient, reliable, and safe. Our domestic network of 27,000 ATMs can be found at Seven & i Group stores, including 7-Eleven, as well as shopping centers, tourist destinations, airports, and stations, to meet the diverse needs of our many customers. We make use of DX to provide unique financial services. For individual customers, we offer convenient account services that support their daily lives. For corporate customers, we offer secure and convenient services that take advantage of Seven Bank’s strengths, including ATMs. At the same time, we are leveraging our ATM operating know-how to expand ATM services in the United States, Indonesia, the Philippines, and Malaysia.

Domestic business

ATM platform strategy

Retail strategy

Corporate strategy

- Consolidated subsidiaries

- Bank Business Factory Co., Ltd

- Seven Payment Services, Ltd.

- ACSiON, Ltd

- VIVA VIDA MEDICAL LIFE CO., LTD

- Seven Card Service Co., Ltd.

Overseas business

Global strategy

- Consolidated subsidiaries

- FCTI, Inc.

- PT. ABADI TAMBAH MULIA INTERNASIONAL

- Pito AxM Platform, Inc

- ABADI TAMBAH MULIA INTERNASIONAL MALAYSIA SDN. BHD.

Unique Business Model

Seven Bank has more than 27,000 ATMs in all of Japan’s prefectures, providing customers with a variety of services. These include the core services of cash deposits and withdrawals, so-called “Smartphone ATMs” that allow customers to deposit and withdraw cash without using cash cards, code settlement, and top-up transactions for electronic money. Since 2023, we have been meeting the diverse, daily-life needs of our customers through new offerings such as the +Connect service, which enables customers to take advantage of facial recognition and reading function for personal identification documents installed in our new, fourth-generation ATMs to complete procedures without visiting financial institutions or government offices. Positioning ATMs as “society’s most friendly digital channel,” Seven Bank will strive to increase their social value.

Business Model for ATM Services (example of main partner financial institution and operating company)

Coexistence and co-prosperity partners

Our core business is to provide customers and affiliated financial institutions with convenient and benefits through Seven Bank ATMs.

We will strive to form partnerships with all financial institutions so that customers can use any of their cards.

| Banks | 123 |

|---|---|

| Shinkin banks | 252 |

| Credit cooperatives | 122 |

| Labor banks | 13 |

| JA Bank | 1 |

| JF Marine Bank | 1 |

| Shoko Chukin Bank | 1 |

| Securities companies | 8 |

| Life insurance companies | 4 |

| Other financial institutions | 151 |

| Over | 676 |

※JA Bank and JF Marine Bank are each counted as 1 institution.

Enhancing the Corporate Value

Seven Bank’s Competitive Advantage

Since its founding in 2001, Seven Bank has positioned the ATM services as a pillar of its operations and worked to expand its ATM network and achieve multifunctional ATMs. We have never loosened the reins while the economic environment and social conditions have been changing greatly but have pursued ATM services that are useful for customers. This persistent efforts have led to the realization of our ATM network, which has the second largest scale in Japan on a unit basis. We are proud that such persistent efforts support the convenience and overwhelmingly competitive advantage of our ATM network.

- ATM as social infrastructure

- We have ATMs at Seven & i Group stores, including 7-Eleven, as well as airports, stations, commercial facilities, and tourist locations. At the present, more than 27,000 Seven Bank ATMs operate in all the prefectures in Japan 24 hours a day, 365 days a year, in principle.

- ATM as service platform

- With the increasing prevalence of cashless payment, the development of services that offer values in addition to cash deposits and withdrawals is under way. Seven Bank will offer various solutions sought by customers and businesses by providing its highly functional ATMs as service channels and combining them with highly specialized services owned by its Group companies.

- ATM that facilitates DX

- Leveraging our nationwide ATM network, we are expanding initiatives to improve both the convenience of customers and operating efficiency of businesses through collaboration especially with startup companies and administrative agencies. Utilization of Seven Bank’s ATMs, which enable personal authentication with ease and safety, will help to increase customer satisfaction and reduce administrative costs incurred by financial institutions.

- ATM that contributes to

solving social issues

- Seven Bank is promoting various initiatives through its ATMs in an effort to realize a sustainable society. We have been realizing our customers’ wishes to see such ATM services as a top-up service for regional digital currencies to facilitate regional revitalization, ATM fund-raising service to enable easy fund-raising through ATMs, a multilingual service to provide convenience for tourists from overseas and non-Japanese residents, and deployment of mobile ATMs to areas afflicted with disasters or other crisis.

- Financial business by one of

the largest retail groups in the world

- Roughly 22.3 million customers visit Seven & i Group stores in Japan every day (fiscal year ended February 29, 2024). We utilize this Group’s customer base to develop and provide unique financial products and services for the convenience of our customers. Toward demonstrating further group synergies, we offer new services that integrate retail and finance to create new values that connect us with our customers in their daily lives.

- Knowledge and know-how

for AI and data utilization

- Seven Bank has worked on the utilization of AI and data from early on and has already utilized the technologies to improve its operating efficiency, such as sophisticating cash management procedures on the ATMs, automatically arranging inquiries sent to the Call Centers, and determining the installation of ATMs in Indonesia. We established the Data Management Office (DMO) and will pursue initiatives such as strengthening the building of awareness inside the Bank and engaging in data business, which is expected to provide a revenue opportunity.

- Top-class corporate services

in the industry

- The environment surrounding the financial industry is changing dramatically. We provide high quality corporate services to respond to the various needs of financial institutions and administrative agencies by combining advanced DX with our expertise and know-how we have cultivated to date such as banking back-office support and systems, authentication and security, and cash settlement functions.

- Active participation of diverse

human resources

- More than 80% of employees at Seven Bank are mid-career employees with highly diverse backgrounds including finance, IT, and retail. We are seeking broad-minded communication through various opportunities to leverage experiences, skills, and networks of such employees with diverse backgrounds and help them to contribute to the implementation of the Seven Bank Group’s Purpose.

- World-class ATM operation

- Toward realization of the non-stop ATM, collaboration with partner companies with highly specialized skills is required in developing main ATM units, establishing system building, responding to ATM outages, and providing security for machines and guarded transport. ATM Call Centers monitor our ATMs 24 hours a day, 365 days a year. In the event of any problems, we quickly respond to ATM outages. As a result, our ATMs are able to achieve a 99.98% operating rate.

- Foster a mindset geared to innovation

- Aiming to establish a corporate culture of open innovation particularly through the promotion of coordination with outside companies and cross-organizational projects, we have established a dedicated department to work on both the building of awareness within the Bank and creation of new business opportunities. In particular, we are focusing on coordination with startup companies to have an opportunity for exploring new business fields.

Value Creation Process

Our value creation is linked to the fulfilment of our Purpose. In order for Seven Bank Group to achieve our Purpose, we set five values that we co-create with our stakeholders as our material issues; fundamental value, social value, creation of new value, source of value creation, and value creation for the future. We are striving to create corporate value through focusing on fulfilling our Purpose and promoting the material issues.

Growth Strategy

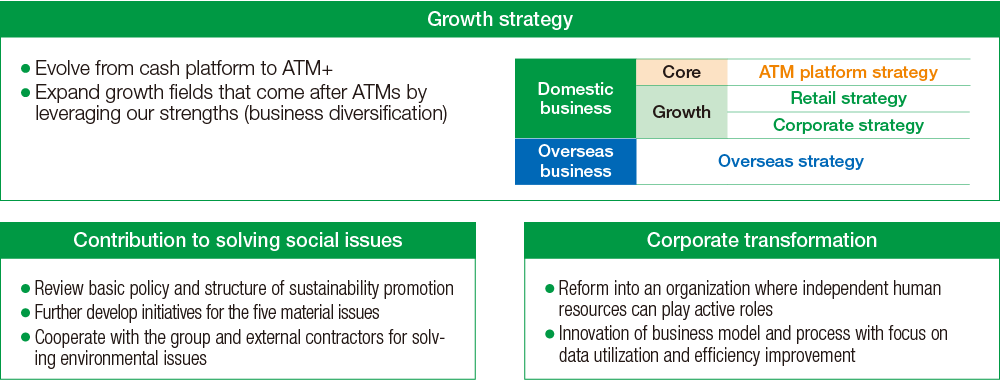

Summary of Medium-Term Management Plan (FY2021–FY2025) and Future Development

In our Medium-Term Management Plan, which we launched in fiscal 2021, we position the five years through fiscal 2025 as the period for giving shape to our second phase of growth. As a unique bank that succeeds in being close-by, convenient, reliable, and secure, we will continue taking on the challenge of new initiatives that provide support for people and society, with a focus on the three pillars of growth strategy, contribution to solving social issues, and corporate transformation.

Overview of Plan

Positioning of Medium-Term Management Plan Period

Initiatives/results in FY2023

Major initiatives in FY2024

To achieve the Medium-Term Management Plan, continue to strengthen the income base, and promote transformation of the business model with an eye to the future.

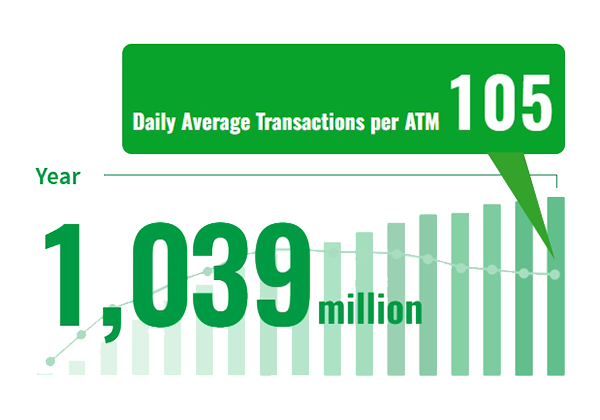

Seven Bank in terms of numbers

Number of ATM transactions per Fiscal Year

The operational rate of our ATMs