Message from the Chief Financial Officer

We will continue aggressive investment based on strong earning and financial foundations, aiming for steady medium- to long-term growth.

Consolidated ordinary income reaches all-time high. Profits were slightly sluggish, owing to a high level of investment.

Managing Executive Officer

in charge of Planning Division, Brand Communication Division, and SDGs Promotion

Ken Shimizu

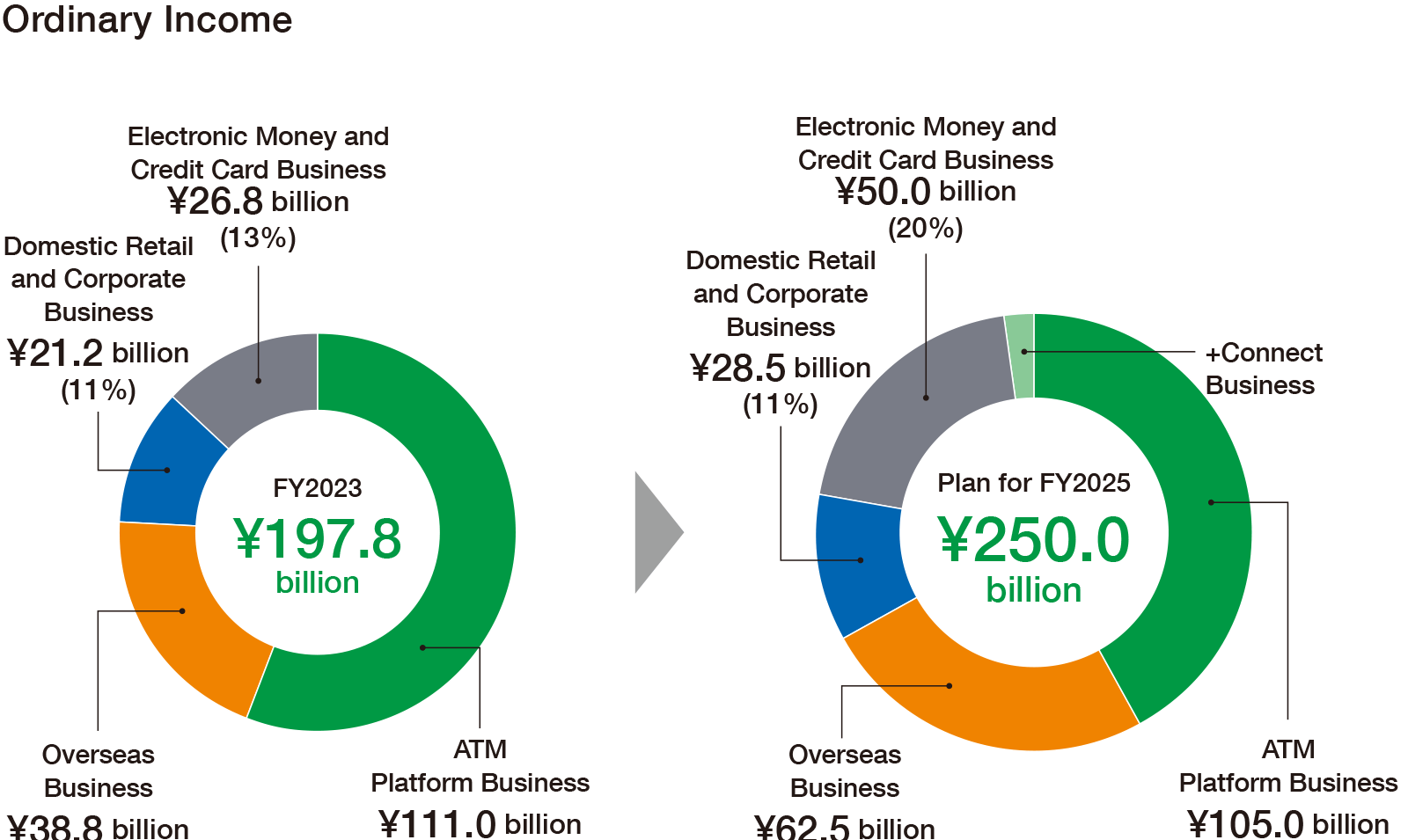

In FY2023, consolidated ordinary income grew by a significant 27.6% year over year, reaching a record high. In addition to the strong performance of Seven Bank on a non-consolidated basis, the consolidation of Seven Card Service as a consolidated subsidiary in July 2023 had the effect of adding 26.8 billion yen on an ordinary income basis. Furthermore, overseas operations, primarily in Asia such as Indonesia and the Philippines, boosted income by nearly 7.0 billion yen. The key factors in the increase are as follows. Our success in securing a reasonable level of earnings in multiple businesses in this way was a major achievement, as it will lead to us realizing our strategy, “constructing a business portfolio with multiple earnings pillars for stable growth.”

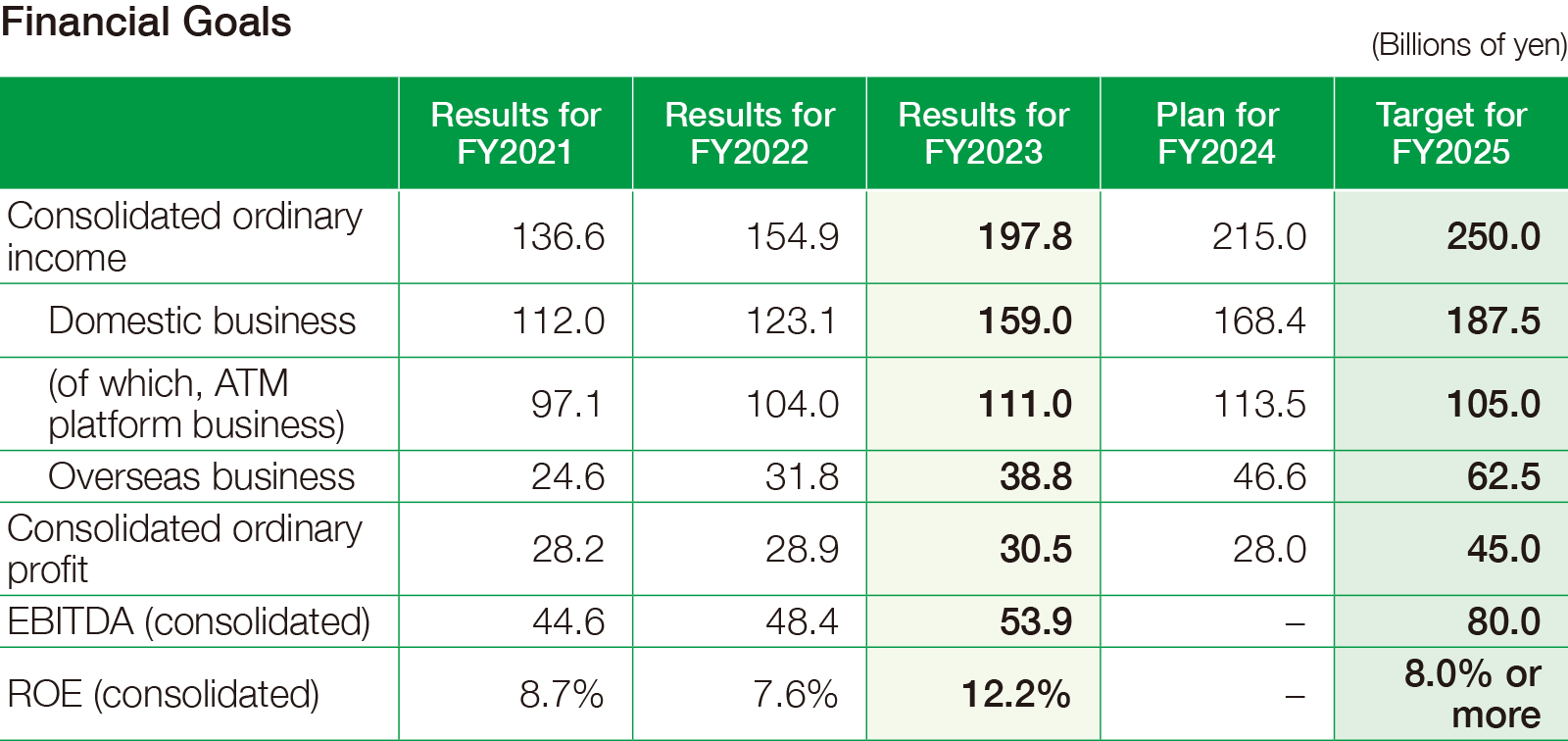

While ordinary income grew notably, ordinary profit increased only 5.5%. This was attributable to increased investment in growth, including fourth-generation ATMs and +Connect services, as well as one-time costs toward support for new banknotes. For FY2024, although consolidated ordinary income is forecast to rise 8.6%, ordinary profit is projected to fall 8.2% due to continued aggressive growth investment and strategic cost allocation in the credit card business.

Since the company continues to invest in a high level of growth, in some respects this is inevitable. Improving the profit margin, however, remains a key issue. Although ROE currently exceeds the cost of shareholders' equity, it has not achieved the 8% target of the Medium-Term Management Plan when excluding gain on bargain purchase resulting from the consolidation of Seven Card Service as a consolidated subsidiary. The only method for improving the profit margin is to work steadily to control costs while expanding profitable businesses and liquidating those that are unprofitable. From this standpoint, we are currently working to steadily grow our ATM platform business while expanding profitable new businesses such as +Connect. And, in our credit card business, while attempting to broaden our member base and expand settlement fees, we are working to raise our profit margin by handling more finance services. We also implemented the liquidation or transfer of subsidiaries where there were no prospects for returning to profitability. Looking at costs, we have numerous fixed costs, such as those related to the management and operation of more than 27,000 ATMs in Japan alone—a number which cannot be reduced rapidly—but we will control this to avoid unnecessary growth.

Medium-Term Management Plan faces profit-related challenges working to bridge the gap

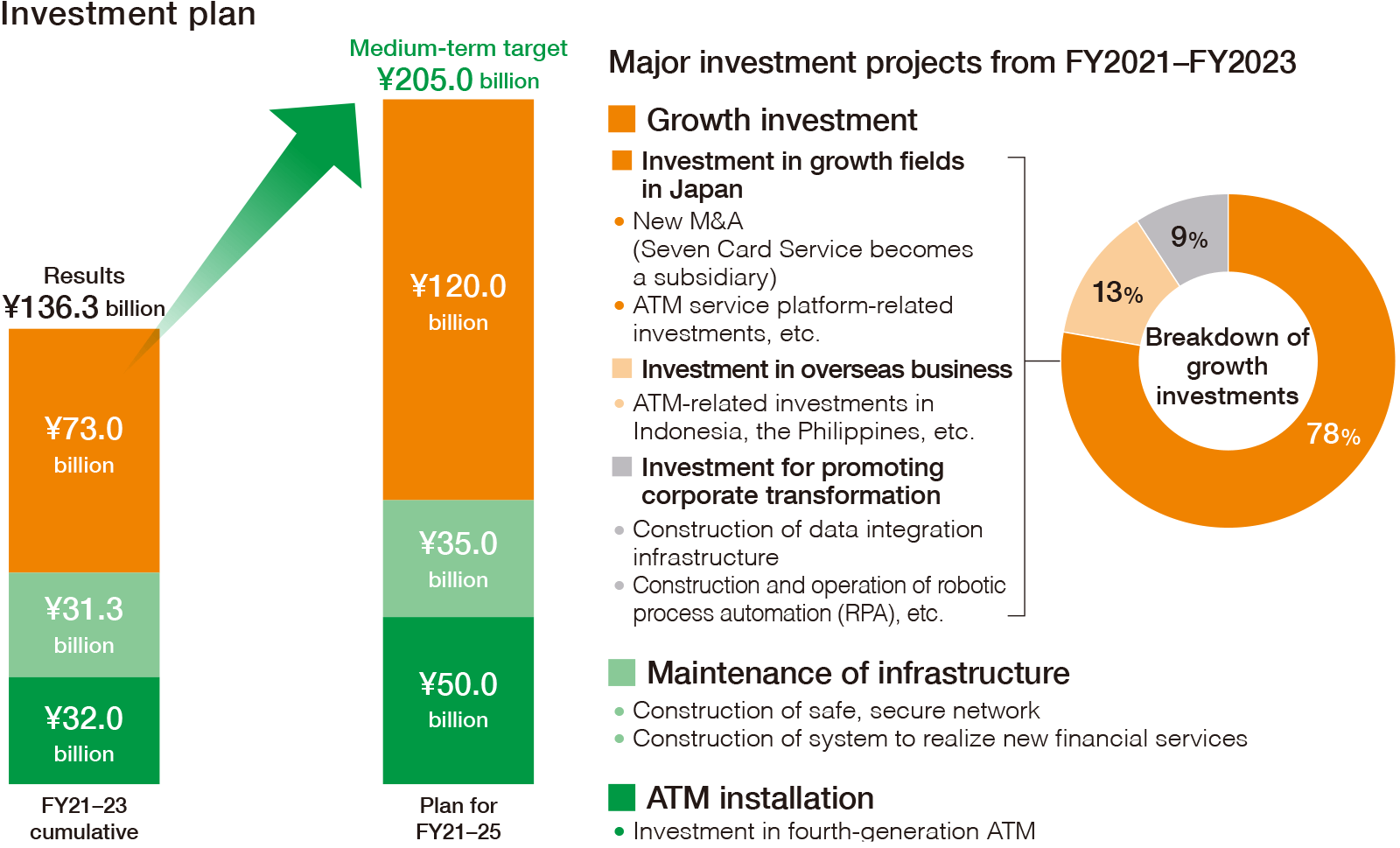

With regard to the Medium-Term Management Plan, in FY2023, we updated the targets in line with the consolidation of Seven Card Service as a consolidated subsidiary. For FY2025, we are targeting consolidated ordinary income of 250.0 billion yen, consolidated ordinary profit of 45.0 billion yen, and an ROE of 8% or higher. We also reviewed the investment plan at that time, and it now calls for an investment of 205.0 billion yen over the five-year period from FY2021 to FY2025.

At this point, we are nearly in line with our plans for progress in terms of ordinary income and our investment plan, but when it comes to profit, there is a slight divergence. The primary factors are the overseas and credit card businesses. Concerning overseas business, the impact of increasing losses in the U.S. business due to factors such as rising interest rates was significant. With regard to the credit card business, we strategically allocated costs to greatly increase the member base, particularly Seven & i Group customers. However, concerning overseas business, in addition to Indonesia and the Philippines, we anticipate further growth in Asian operations, including Malaysia, where we have plans for new development. In the U.S., we expect to capitalize on the renewal of the contract with 7-Eleven, Inc. to expand the scale of operations and enhance profitability. In the credit card business, we are aiming to increase the customer base by five or 10 million by reinforcing ties with 7iD, the common membership base of the Seven & i Group. We are convinced that we can change profitability and viability significantly if we succeed in expanding our financial services based on this membership base.

Certain aspects are contingent on the timing of profit contributions from the credit card and overseas businesses. While assuming a variety of possibilities, including M&A, however, we will continue our efforts to fill in the gaps without giving up on achieving our goals.

Aiming to leverage the collective strengths of the Seven & i Group to further expand the scale of business

The entire Seven & i Group's annual revenues from operations exceeds 11 trillion yen. Looking at other corporate groups, financial business accounts for approximately 4-5% of their total revenues from operations. Given this, we believe that we have the potential to achieve consolidated ordinary income on the order of 500.0 billion yen. To achieve this, we must fully leverage the comprehensive strengths of one of Japan's largest retail distribution groups. In both the account and credit card businesses, with 7iD at the core, we believe that if we can accurately respond to customer needs while leveraging the comprehensive strengths of the Seven & i Group, we will be able to significantly boost account and member numbers from the current level.

Moreover, there is considerable room for growth in new businesses such as +Connect, the corporate business handled by group companies Bank Business Factory and Seven Payment Service, and the security-related business operated by ACSiON.

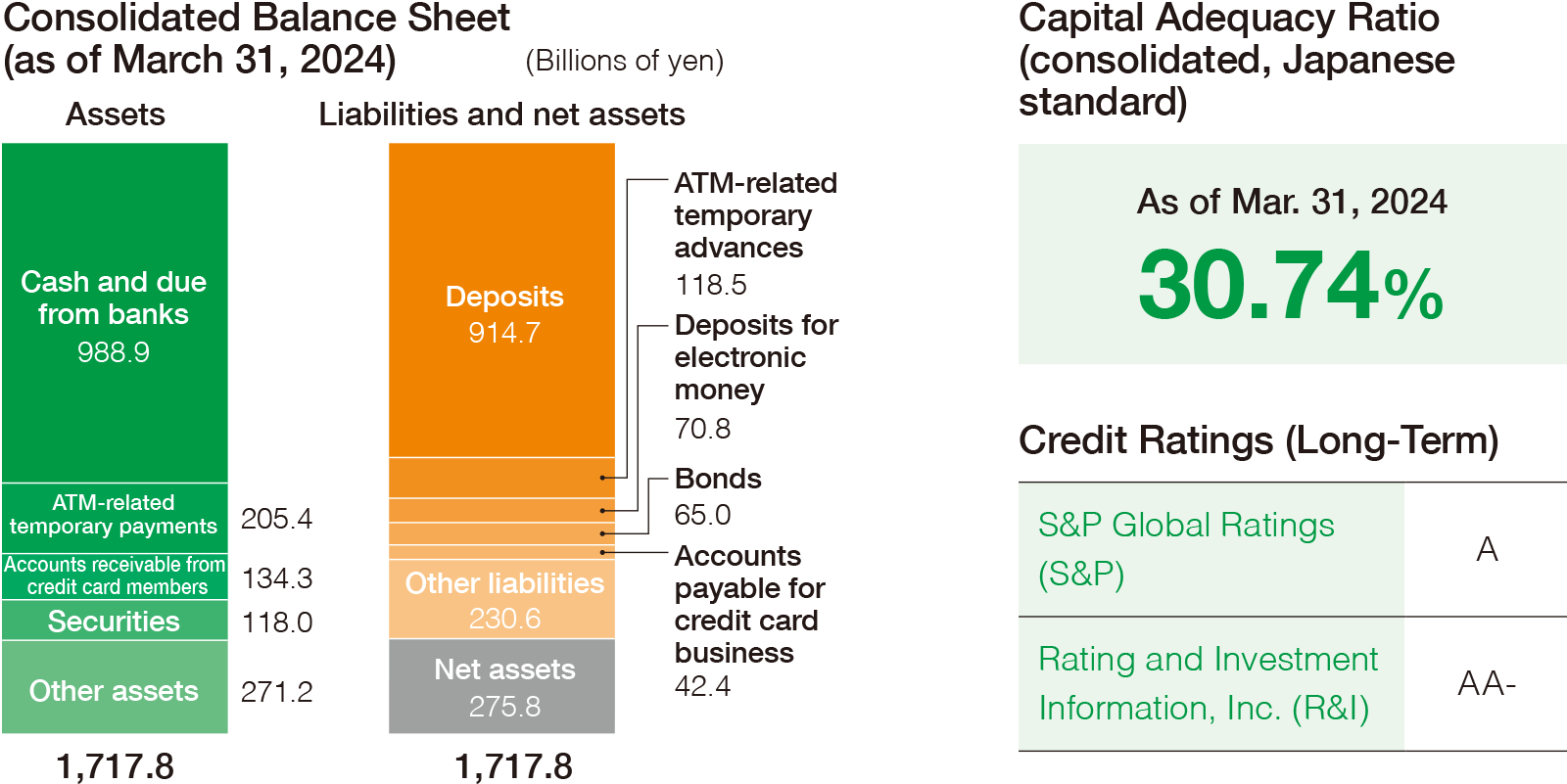

If, in addition to our domestic and overseas ATM platform businesses, we can grow these businesses as well, we believe that going forward we can achieve income and profits that surpass the current Medium-Term Management Plan. Because there is quite a bit of advance investment for growth, some may have concerns about short-term profits, but we believe that we will be able to continue on a steady growth path in the medium to long term. Our capital adequacy ratio remains high, and we expect to secure ordinary profit of 28.0 billion yen in FY2024—despite profits actually falling—so we are still sufficiently strong. Please understand that our aim is to achieve medium- to long-term growth while also investing aggressively based on a strong financial foundation.

The immediate goal is, through profit growth, to achieved increased dividends.

We will work to be evaluated in terms of medium- to long-term total shareholder return as well.

Boost medium- to long-term corporate value by balancing growth and profitability from an overall optimization perspective

I acknowledge that, as CFO, my most vital role is to heighten medium- to long-term corporate value by considering and implementing management and financial strategies—as well as resource allocation—that balance growth and profitability, always from the standpoint of overall optimization. We also believe it is important to construct relationships of trust by maintaining close communication with stakeholders inside and outside the company and thoroughly explaining these strategies to them. We believe it is essential to carefully explain our future growth potential, particularly now that advance growth investments have resulted in a decline in profit levels.

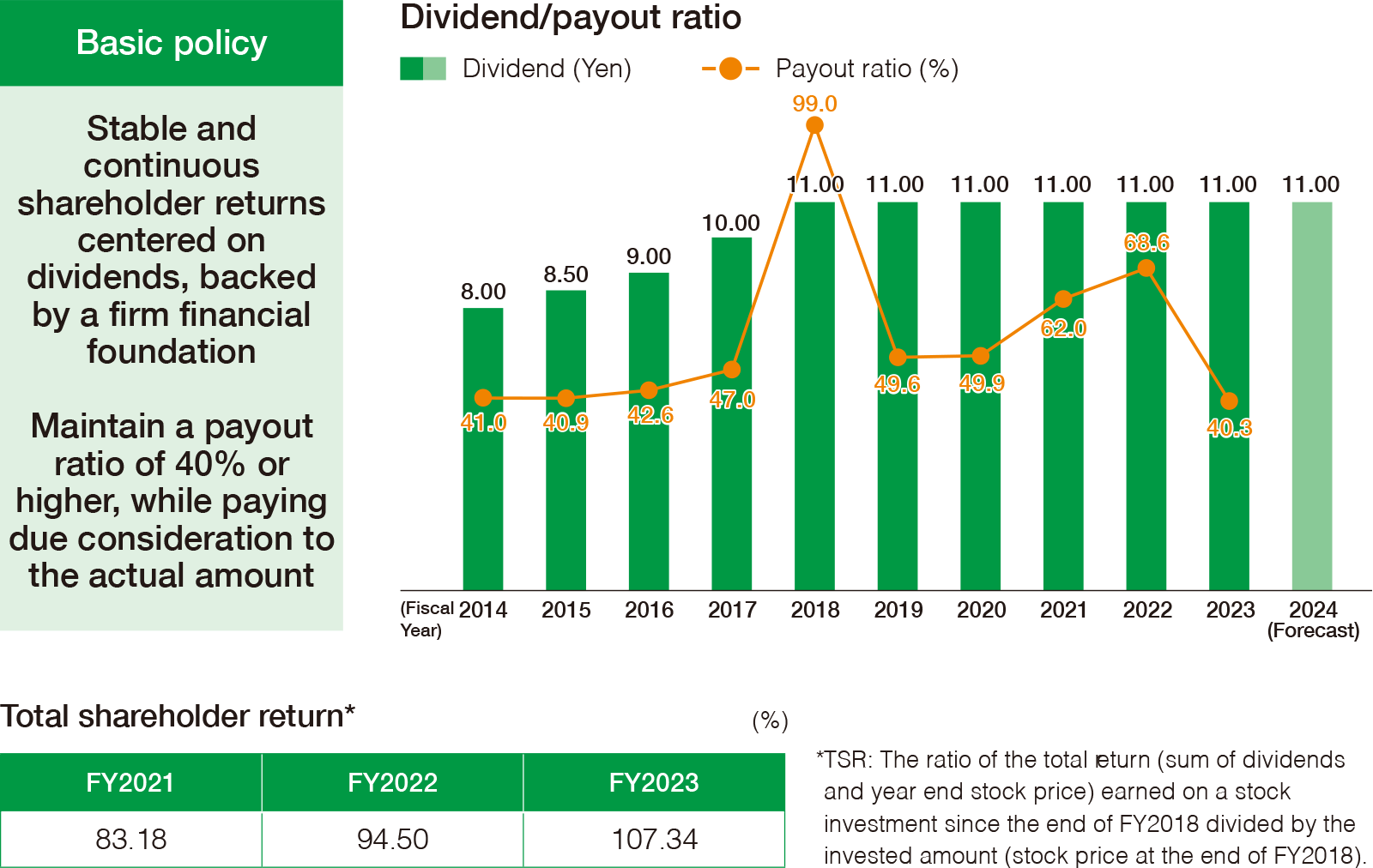

With regard to shareholder returns, we have continued to pay a dividend of 11 yen per share annually for the past several years underpinned by our basic policy of maintaining a payout ratio of 40% or higher, while paying due consideration to the actual amount. We will continue to adhere to this policy and, in line with profit growth, work to increase dividends. Although we were founded just over two decades ago, we are still a growing company. We will strive to be recognized not only in terms of dividends, but also in terms of total shareholder return, including medium- to long-term capital gains.

- Management information

- Message from the President

- Management Policy, Management Environment, and Issues to be Addressed,etc.

- Risk Factors

- Risk Management Initiatives

- Compliance Initiatives

- Medium-Term Management Plan FY21-FY25

- Stock and bond information

- Stock Information

- Dividends and Shareholders Returns Policy

- Corporate Bond and Rating Information

- General Meeting of Shareholders

- IR Library

- IR News

- Financial Statements

- IR Presentations

- IR Calendar

- Annual report

- Seven Bank Disclosure Policy

- Other Corporate Information

- Company

- Sustainability