“+Connect”: ATMs That Create the Future

Perform all types of procedures and certification via ATM

We will contribute to the creation of an all-inclusive digital society with our ATM platform strategy.

Developing ATM services from the user's perspective as a bank born of the retail industry

Managing Executive Officer

in charge of the ATM Solution Division and the ATM+ Planning Division

Koji Fukasawa

We are a bank that originated from the concept that it would be nice if there were ATMs at convenience stores. Under the catchphrase “ATMs anytime, anywhere, by anyone”, we have continued working to develop and improve the infrastructure of ATMs. It is not easy to construct an ATM network that operates continuously, 24 hours a day, 365 days a year. Adopting the same mindset as in the world of convenience stores, however, which operate on the premise that even a single missing item is a serious issue, we have pioneered a number of innovations, such as constructing our own network to ensure stable ATM operations and utilizing AI. In addition to the screen display, the UI/UX is highly refined, with thorough attention paid to details such as the comfort of the keyboard touch and sound effects. Our stance of placing customer convenience and ease of use first—the unique attitude of a bank born of the retail industry—and the many initiatives we have undertaken have been appreciated by customers and business partners, which I believe has led to the expansion we have achieved for our ATM business.

New ATM strategy “+Connect” is launched.

Toward an era in which all procedures are “connected” via convenience store ATMs

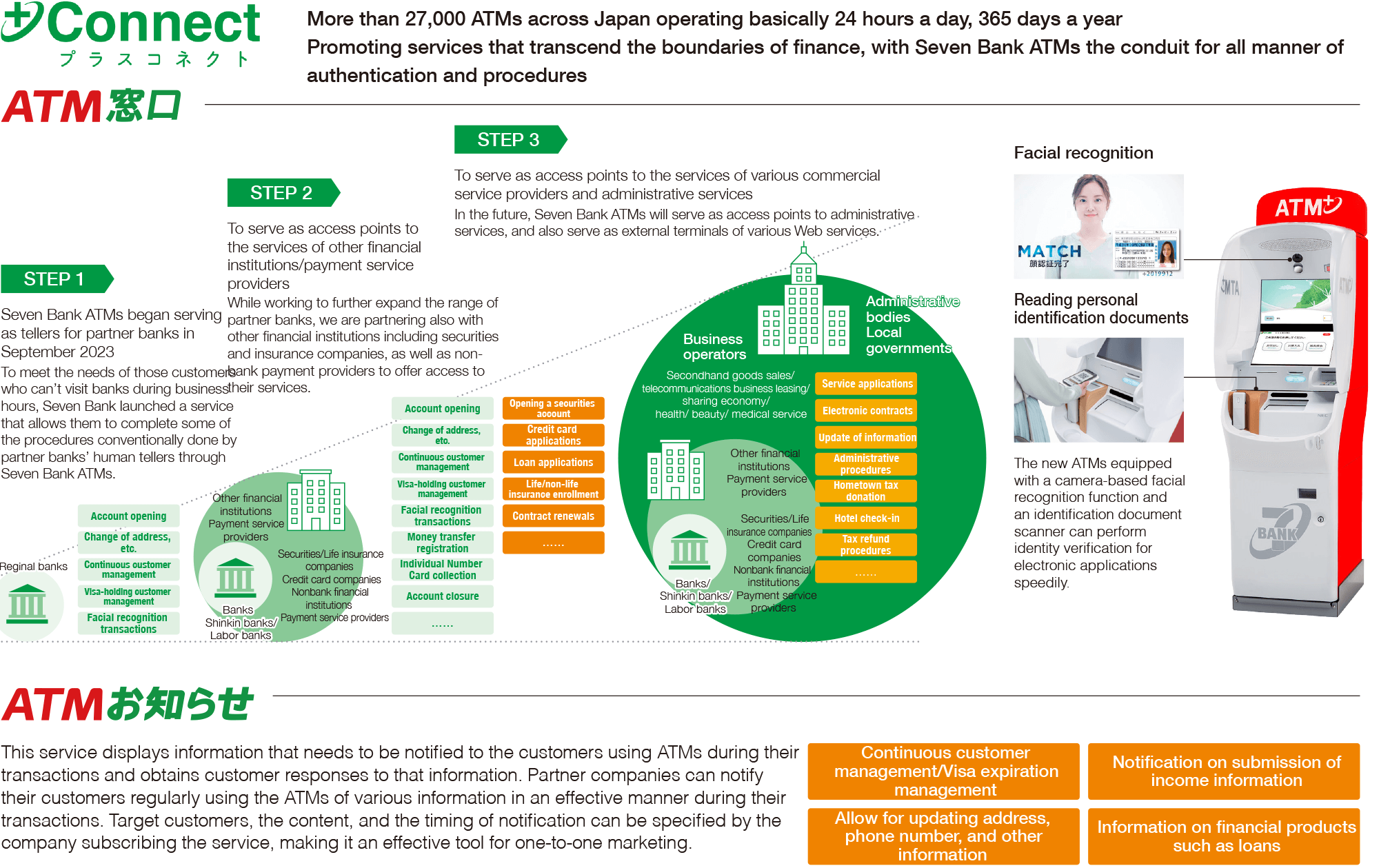

Our fourth-generation ATMs, which we started rolling out across Japan in 2019, are scheduled to completely replace all over 27,000 units nationwide by the end of FY2024. With the new ATM infrastructure nearly in place, the next step will be to promote +Connect, our ATM service platform strategy that will provide the world with new experiences and value. As that first step, in September 2023, we began providing ATM Teller and ATM Notification services*1. The pillar of the +Connect business concept is to create a world where various procedures and certification that had been performed at the counter or in person can be accomplished at 7-Eleven stores anytime.

The driver behind the introduction of this service is the declining availability of over-the-counter service at banks in Japan. The promotion of online banking and applications as alternatives is spreading, but various issues exist, such as IT literacy and concerns over security. This led us to the idea that our ATMs—located close to our daily lives and used regularly—could provide customers with new value, improve the bank's operational efficiency, and take on the role of a teller's window to reinforce points of contact with customers. As of July 2024, 10 months since the service was launched, nine banks have already introduced the service. We have also made steady progress in growing the number of companies contracted for introduction. In addition to banks, we have also found that credit card companies and other businesses have a need for this service, and several projects are already in progress. We are looking at expanding into insurance and administrative procedures going forward. Our view is that the market for such in-person procedures will reach several trillion yen in Japan, and that capturing even a small percentage of this would be a business of considerable size.

- ※1ATM Teller: A service that allows customers to complete applications to open bank accounts and change their registered information at ATMs.

ATM Notification: A service that provides ATM users with one-to-one information.

Toward expanding +Connect strategy

The system's utilization results show that its effectiveness exceeds initial expectations, and companies that have adopted the system have assessed it as being a useful, non-face-to-face point of contact with customers in a real-world setting. Specifically, from an anti-money laundering perspective, banks face pressing issues such as continuous customer management*2 and managing residency deadlines for foreign residents. Compared with means we have used in the past, such as mail, e-mail, and short messaging, we found that the rate of the customer response to ATM Notification was in the 70 to 80% range. Furthermore, when changes in registered information are discovered, ATM Teller serves as a one-stop solution for performing procedures. Seventy percent of the total number of transactions were performed during hours when bank tellers were closed, and the time required to complete an ATM transaction was only three minutes, demonstrating just how convenient this service is. Customers who have used the service have in fact welcomed it, as evidenced by comments such as, “It is convenient because it is near where I live and I can use it at my convenience even outside of bank business hours,” and “Operation is very simple.” Meanwhile, this initiative has just gotten underway. We are currently communicating with a number of banks and companies regarding introducing the system to enable use by as many people as possible in the very near future. We also conduct a variety of promotions to inform customers of the system. We will continue to focus on expanding the +Connect service to facilitate rapidly offering a world in which easy, convenient procedures become matter of fact at convenience store ATMs.

- ※2Continuous customer management: Efforts to ensure customer information is up to date by periodically confirming customer names, addresses, and other identification information, as well as the purpose of account use.

It is still important to pursue service and planning from the standpoint of the customer in promoting the +Connect strategy.

Keep an eye out for our ATM platform strategy, which also provides significant value to society.

We position our ATMs as “the easiest digital channels in society.” We will continue to proactively expand unique services such as credit card and insurance applications, money transfer registration procedures, and hotel check-in. We believe that this will heighten our value to society as a service platform that provides a secure environment for various types of settlement, procedures, and certification. It will help to realize the government's goal of “a digital society where no one is left behind.”

On top of that, what is important is pursuing the customer's perspective, which is also connected to our Purpose. We believe that our mission, as a bank born of the retail industry, is to provide services that surpass “seeing your wishes and going beyond” with a sense of speed, while refining our UI/UX, staying attuned to our customers' changing needs, and keeping pace with the times and technological evolution. We will continue to create new conveniences and a new way of living that only ATMs located in real places close to our daily lives are able to offer. And we aim to further enhance our corporate value by providing these services.

- Management information

- Message from the President

- Management Policy, Management Environment, and Issues to be Addressed,etc.

- Risk Factors

- Risk Management Initiatives

- Compliance Initiatives

- Medium-Term Management Plan FY21-FY25

- Stock and bond information

- Stock Information

- Dividends and Shareholders Returns Policy

- Corporate Bond and Rating Information

- General Meeting of Shareholders

- IR Library

- IR News

- Financial Statements

- IR Presentations

- IR Calendar

- Annual report

- Seven Bank Disclosure Policy

- Other Corporate Information

- Company

- Sustainability